CEO.ca - For the first time NGEx Resources pulled together the 60%-owned Jose Maria and Los Helados copper-gold deposits into a single mining scenario - now called the Constellation project - in a preliminary economic assessment.

It's big.

NGEx, about 19.9% owned by the Lundin family trusts, had previously envisioned a standalone operation at Los Helados, but in drawing them into one plan aims to show cost reductions, efficiencies and shear scale.

"It's an important milestone," said Wojtek Wodzicki, in a conference call early Thursday.

The mining project, encompassing some 2 billion tonnes of resources, would start with open pitting of the Jose Maria copper gold deposit, in Argentina, and begin transitioning to mill feed from Los Helados, in Chile, which would be block caved.

NGEx plans include 529 million tonnes @ 0.36% copper and 0.26 g/t Au of indicated resources from Jose Maria's broader deposit (along with minor inferred resources) and 1.3 billion tonnes of indicated resources @ 0.40% Cu, 0.15 g/t Au and 1.44 g/t Ag and 277 million tonnes inferred resources @ 0.34% Cu, 0.1 g/t Au and 1.43 g/t Ag from the otherwise larger Los Helados deposit.

With about 2 billion tonnes in resources in the mine plan, NGEx projects a 48-year mine life, 50 include pre-stripping, and production averaging 150,000 tonnes copper, 180,000 ounces gold and 1.2 million ounces silver a year.

One of the major changes in Constellation versus a standalone operation at Los Helados is the benefit of more accessible water on the Argentine side of the border for processing. Wodzicki highlighted that as one of the key differences between the project NGEx is proposing and some other large-scale mining projects in the High Andes that suffer water access. It also reduces costs versus long-distance piping or desalination.

In permitting, the cross-border nature of the project adds a layer of complexity. But in a follow-up email after the conference call Wodzicki noted that the project falls under the Mining Integration and Complementation Treaty between Chile and Argentina.

"We have been doing exploration on both sides of the border under this treaty for the last 10 years," Wodzicki said. "It was specifically designed for cross border projects like Constellation."

Along with the large scale nature of Constellation comes a hefty capital cost estimate at just over $3 billion. That more or less assures NGEx will require a major miner or the like to buy or heavily partner on the project to fund it. NGEx, in determining economics, used longterm prices of $3/lb Cu and $1,275/oz Au (well over recent spot prices). At those prices the project yields a $2.1 billion net present value. At $2.50/lb Cu that drops to $890 million, in each case discounted at eight percent and considered after-tax.

In location, lucky for NGEx, the Constellation project is close to operating mines of like scale and grade, notably the Caserones project in Chile. In this regard there's no doubt Constellation will be closely watched by majors as a potential source of future operations or feed for that matter.

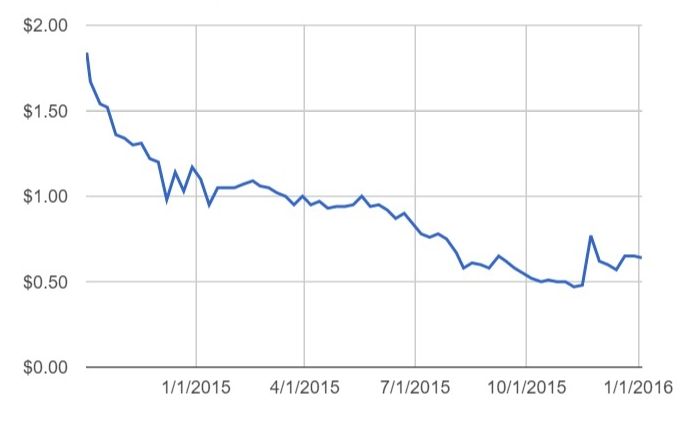

NGEX RESOURCES (NGQ)

Working capital: $3.4m (Sept. 2015)

Shares issued and outstanding: 188 million

Marketcap: $126 million