This morning, Pilot Gold (PLG:TSX) which is best known for a growing series of large-scale copper porphyries in Turkey as well as a 'Long Canyon lookalike' in Nevada, has now added a Utah project to its fold. The company announced this morning, that they have agreed to acquire Cadillac Mining for shares valuing the company at roughly $7 million.

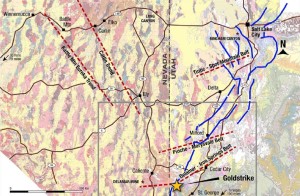

Cadillac holds the Goldstrike project, located in western Utah, which is a sediment-hosted gold project that produced roughly 209,000 ounces of gold from 1988 to 1996 in an open-pit heap-leach operation.

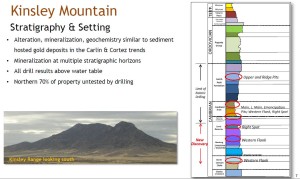

Pilot's team is not afraid of going against the grain when it comes to exploration. They ignored the existing dogma when they discovered the Long Canyon deposit in the eastern Great Basin area. They did the same, more recently, with their Kinsley project. They hit significant high-grade gold in the deeper Paleozoic stratigraphy at Kinsley Mountain.

Cadillac's Goldstrike, is located just across the Nevada-Utah border in Utah. Prior to the team's discovery of Long Canyon, geological interpretation of that area said that no Carlin or Bald Mountain style gold deposits existed there. Pilot's team disagreed and they reaped the rewards.

Although I am not a geologist, I've been told by some smart ones that 'rocks don't care about borders'. If this proves to be the case, then this acquisition could prove to pay itself back many times over for Pilot.

"Upon closing of the acquisition, Goldstrike will enhance our high-quality portfolio of eastern Great basin projects," stated Matt Lennox-King, President and CEO of Pilot. "This transaction provides us with another data-rich past-producing oxide heap-leach project that our team will incubate as we continue to advance our Kinsley and TV Tower projects. With two significant porphyry discoveries at TV Tower and ongoing growth at Kinsley, Cadillac shareholders will gain access to our world-class advanced exploration portfolio, strong treasury and Pilot Gold's proven technical and management team."

The offer of 0.12195 Pilot shares for each Cadillac shares represents a 121% premium to Cadillac's prior closing of $0.09 per share.

Insider's of Cadillac own roughly one third of the company and are all in favor of the transaction as it provides them with continued upside in their project, allows the project to receive adequate capital to test the theory and provides shareholders with access to both Kinsley Mountain and the Turkey projects.

Goldstrike could prove to be another Kinsley Mountain (which, in turn, could prove to be another Long Canyon). If they can prove the theory that significant mineralization lies within the deeper stratigraphy like at Kinsley Mountain, then this $7 million acquisition could be worth hundreds of millions of dollars.

The Kinsley Mountain discovery, made in mid-January of this year has added roughly $70 million in market capitalization to Pilot (bringing their share price from $0.95 up to a high of $1.67 per share.

I would expect that the theory will be a relatively easy one to test, given their repeated success at Kinsley Mountain since making their initial discovery this year. They should be able to do a small program and test the same horizons as Kinsley to see whether Carlin or Bald Mountain style mineralization exists there.

In summary, this acquisition could prove to be one of the best in terms of return on investment for the following reasons:

- They are using their paper which has outperformed YTD

- They are paying next to nothing for it

- The cost-benefit is potentially huge given the fact it shouldn't be too expensive or technically onerous to test their thesis

Here's the YTD chart:

Read: Pilot Gold enters into agreement to acquire Cadillac Mining Corporation