A fun story for mining and US history buffs and an argument for continued strength in copper demand.

Stanford University, located in Palo Alto, California, and today known as the epicenter of technology, has graduated untold thousands of students. However, as with most top schools in the world, few of those graduates have chosen mining-related careers. But shortly after Leland Stanford founded the famous school in 1891, its self-styled “first student ever” was a young geologist who went on to lead one of the most exciting and successful lives of any American in the 20th Century.

In 1897, this young graduate had to move to a far-off wilderness, specifically the gold fields of Western Australia, to seek work as a geologist and mining engineer. Four years later, he became a partner and investor in the London-based mining concern, Bewick, Moreing & Co. which eventually controlled 50% of gold production in Western Australia.

As this ambitious young Geo was turning 31, in 1905, the great nations of Europe with vast colonies (or the lack thereof in the case of Bismarck's unified Germany and Austro-Hungary) began to jockey for world domination that would eventually start World War I. Geology and metallurgy made growth possible as the world entered the first major phase of "copper, steel and oil" industrialization.With some partners, our intrepid Geo formed the Zinc Corporation (ZC), which later became the "Z" Rio Tinto's RTZ.

ZC’s intention was to purchase and treat the zinc-rich tailings in Broken Hill, Australia, and solve the “Sulphide Problem”. ZC did so with the help of Jim Lyster, eventually leading to the industry-changing Lyster flotation process. This process enabled ZC to operate the world’s first selective or differential flotation plant in 1912. Since our young geologist had graduated from Stanford, cars, planes and electricity had become commonplace and it was all possible due to “mining technology”.

By 1914 our globe-trotting Geo, nicknamed "Doctor of sick mines", had become a wealthy man, with an estimated personal fortune of $4 Million ($100M today). In the years that followed he would become insanely wealthy with investments on 6 continents and offices in SF, London, NY, Paris, Burma, and St. Petersburg. He gained what he later described as "a large fortune from these Russian industries, probably more than is good for anybody". To this day, our young Geo’s English translation of the 1556 mining Bible, De re metallica, is still the most important scholarly version.

President Hoover

So who was Stanford's "first student ever", later to become a globetrotting geologist and one of the world’s wealthiest men? He was Herbert Hoover, who went on to become the 31st President of the United States.

But those days are gone. There has never been such a vacuum of new graduates for the mining industry as in the past few decades. Students the world over have focused on computers and software rather than falling grade and limited profits in the dead and boring industry of mining.

Dead and boring, with no profits? Hardly. From Hoover's life, we can all learn that a graduating student in mining/geology/engineering can make "insane" amounts of money -- possibly more than would be the case in software or technology and a roving mining executive's life could rival that of any modern television drama.

As metal prices finally started to climb in the early 2000's, few believed that growth was sustainable. Even many of the industry executives followed the mantra “those who know it the best, love it the least because they have been hurt the most”. Today, with ongoing nervous financial markets and a lack of youth in the mining industry, it is the supply side that investors should focus on more and less on the over-publicized possible demand destruction.

In 2008, during the all-asset class sell-off, it was supply destruction instead of falling demand that bounced copper from a $1.35 p/lb low to $3.50 p/lb in 12 months. Clearly, if 1/3 of global copper production was about to go bankrupt -- and it would have in 3-6 months due to broke and/or nervous shareholders and bankers -- it didn't matter that demand had slipped 5-10%.

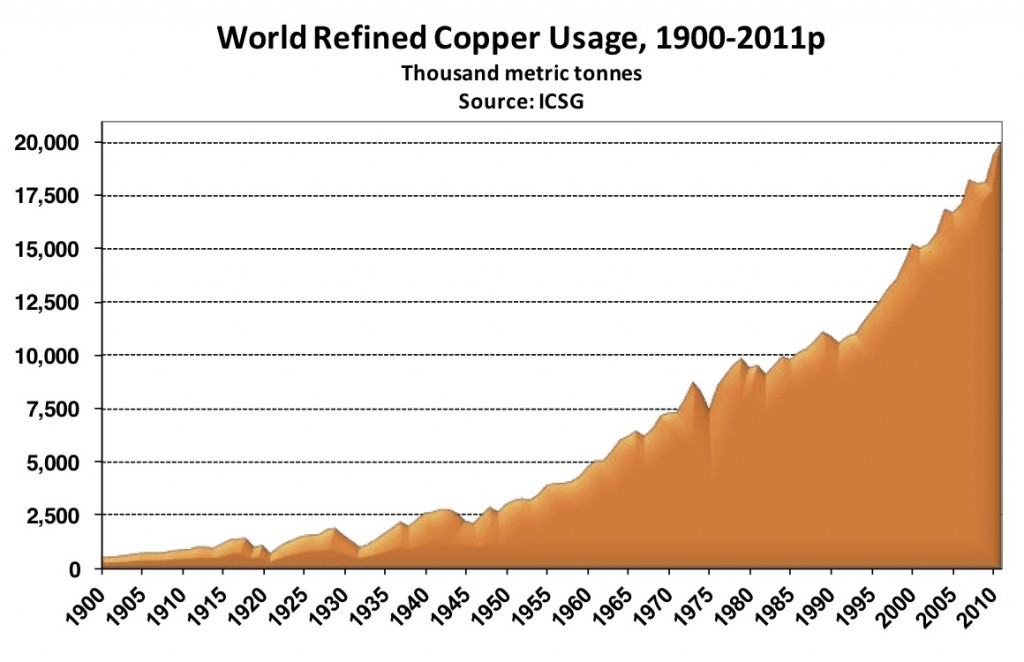

The single most relevant "insurance policy" for copper investors today is that few major new mines have been found in the past ten years, and even fewer mines are being financed and brought to production today. Meanwhile, demand growth for copper -- since the time of President Hoover's graduation -- has never stopped and has now reached 20 Mt per annum (view below chart). Growing at even 3% per year, the copper mining industry needs to supply an additional 600 k/t's of new supply per year.

Really?

(Source: ICSG World Copper Fact Book 2012

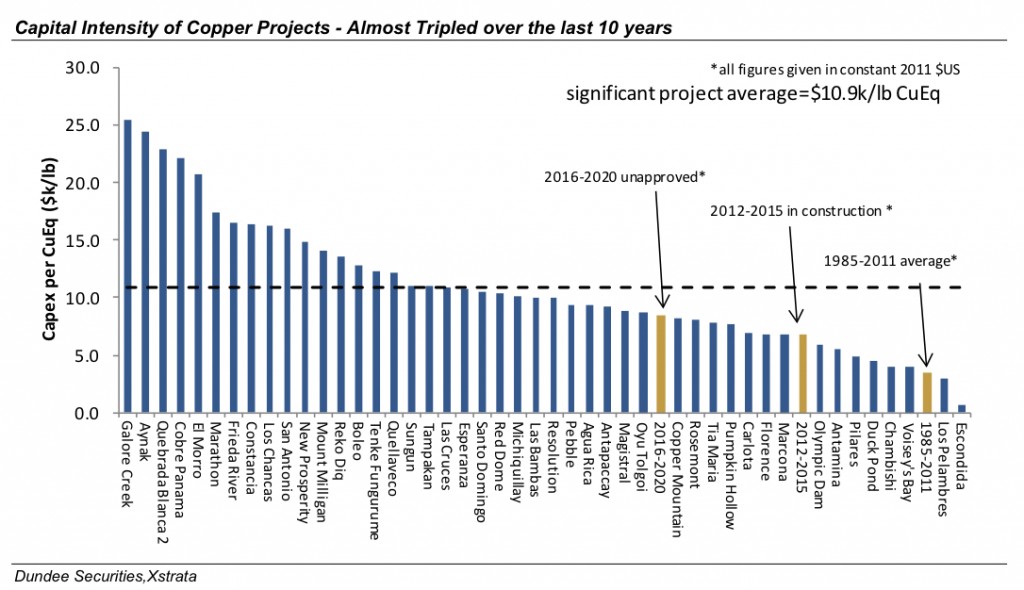

The question investors should be asking is not when will the new mines be developed, because they must, but who in their right mind would finance a new mega-project in this market? However, therein lies the contrarian opportunity in this market. Investors often look at copper deposits by pounds in the ground and quality of the deposit, and then place a metric on how much p/lb of copper or Cu/eq is the deposit worth "undeveloped". (Ed. note: during the past boom years all the M&A transactions for copper deposits have been between 0.03 and 0.10 p/lb --(higher on select deals) -- of copper in the ground. Does that apply anymore in this crazy market? Perhaps a more relevant metric for investors in these nervous, difficult-to-finance markets, is to look at advanced-stage projects on the basis of cap-ex per tonne of production as listed in the chart below.

In this investor’s opinion, it is only Big Mining, which is literally printing cash with $3 copper, which must replace depleting reserves and will finance/take-over logical projects even in this market.

(Source: Base Metals & Coal Report- Dundee Capital Markets - July 19, 2012)

As one can clearly see from the far left side of the chart, most of the current large-scale development projects have a capital intensity well in excess of $20,000 p/t of production. On the far right of the chart are the legacy projects that were built in the 80's & 90's (not much has been built in the 2000's) with one interesting exception, Nevada Copper's (TSX - NCU) 100%-owned Pumpkin Hollow project which has a demonstrably low capital intensity of $8,000 p/t of production, similar to a 90's project. With copper currently trading at $3.35 p/lb ($7,300 p/t) it requires only very simple arithmetic to see why projects like Pumpkin Hollow offer larger companies the rationale to consider financing quality, low-cost expansion even in these difficult markets.

For close to four decades there has been an almost idiotic oversupply of copper metal on the market, exacerbated by the SX-EW expansion of 2Mt p/annum during the 80's & 90's in the US and Chile and the fall of the Berlin Wall on November 9, 1989. While the industry was in hibernation, it had become a club of grey-haired dinosaurs that few young minds would ever aspire to emulate as an exciting path to adventure and untold riches.

This leaves the R & D side of the business void of Generation X. In simple terms: From the 1960's to 2000 it was musical chairs where everyone had a chair, then suddenly the music stopped and nobody noticed the hundreds of millions of people who had joined the consumption party. Due to the brain drain, lack of investment and an almost-impossible- to-permit climate, there is still not enough near-term copper supply to satisfy basic demand. Thus, even through these nervous times, copper continues to trade at $3.30 p/lb, affording investors opportunities like Pumpkin Holllow, valued at 0.01 p/lb of copper in the ground ~45% of which is proven and probable.

The end.

For executive search within the mining industry, CEO.CA recommends The Mining Recruitment Group.

For executive search within the mining industry, CEO.CA recommends The Mining Recruitment Group.

Email: info@miningrecruitmentgroup.com

Tel: 1.604-696-2929

DISCLAIMER: Gianni Kovacevic has a conflict of interest as a past consultant to and a shareholder of Nevada Copper Corp. (NCU) and thus stands to profit from share price appreciation. This introduction is for information purposes and all information contained within should be verified by the reader. It is strongly recommended that readers perform their own due diligence and contact management of NCU directly AND A QUALIFIED INVESTMENT ADVISOR if and when there would be any follow up questions with respect to the statements made above. The purpose of this information is to encourage the reader to initiate a proper due diligence process. To sign up for Gianni's email list please click here. For more about Gianni visit: Kovacevic.com.

ADDITIONAL DISCLOSURES: The owner of this web site is also a small shareholder of Nevada Copper Corp. through a company he controls - so the same conflict of interest applies. CEO.CA nor any of its' affiliates were paid to disseminate this piece. We urge readers NEVER to make investment decisions based on content read at CEO.CA. Thank you. Please see our full disclaimer.

LooooooL

??