Buying Into Panic Can Pay Millions--And Sometimes Billions--If You Have The Guts.

The hypnotizing stench of market pessimism never ceases to amaze me. It wraps itself around it’s victims like a heavy smoke—choking them into a deep financial slumber. Some wake up weeks, months, or years later, dazed and confused, while others simply perish.

Optimism on the other hand, is like a piercing beam of light. It’s like opening a window when something’s burning on the stove—calling forth the cavalries of warmth and fresh air.

While many might agree with said analogy on optimism vs. pessimism, very few have the actual courage to operate from a place of optimism during a bear market. During bear markets, writers and commentators scare the bejesus out of anyone who will listen, many knowing full well that fear can cause an uninformed man to fall back with an open wallet and beg for mercy! As Roosevelt famously said, “The only thing we have to fear--is fear itself."

While many might agree with said analogy on optimism vs. pessimism, very few have the actual courage to operate from a place of optimism during a bear market. During bear markets, writers and commentators scare the bejesus out of anyone who will listen, many knowing full well that fear can cause an uninformed man to fall back with an open wallet and beg for mercy! As Roosevelt famously said, “The only thing we have to fear--is fear itself."

In particular, this concept couldn’t be any truer today when looking at the resource sector. In fact, there is less risk today in mining stocks than at any other time since the 2008-2009 crash. There’s an old saying that goes, “You can’t kill yourself by jumping out of a basement window”, but in this case I would rephrase it as, “You can’t kill yourself by CLIMBING OUT of a basement window.”

While the smoke of pessimism wreaks havoc on the minds of retail investors, the optimistic company builders and fund managers with successful track records are busily planting seed for the next up cycle. They are quickly and quietly securing new properties and investments on behalf of their clients and shareholders. The fact that men drop like flies in the presence of choking pessimism—serves to the great wealth-builder’s advantages!

In a recent conversation with Ross Beaty, Pan American Silver founder, and creator of over $4 billion in shareholder wealth, he commented that, “Long term I believe the supercycle in commodities is alive and well, and probably the smartest money will be made by those with the courage to go long and strong into metals equities RIGHT NOW.”

This sentiment was also echoed in a recent interview by Sprott Asset Management’s Rick Rule in which he stated, “For the people who pick stocks, these are the best of times”.

Additionally, I brought the conversation to the attention of junior resource developer Amir Adnani(a Casey “NexTen” honoree), in which he told to me that, “The opportune times to grow – to acquire projects, companies, shares of companies – are when valuations are low due to market fear…Today’s extreme bear market in resources makes a textbook example. Our company…is purchasing an advanced gold project…for $17/oz., defined gold resources in the ground in an active mining region with strong infrastructure...During normal times, the same gold ounces would be valued at $100 to $120/oz…[or] 3 – 8 times as much for the same gold…Wealth creation in the resource sector is all about timing, and having funds when others don’t, and having the guts to act when times are hard.”

Additionally, I brought the conversation to the attention of junior resource developer Amir Adnani(a Casey “NexTen” honoree), in which he told to me that, “The opportune times to grow – to acquire projects, companies, shares of companies – are when valuations are low due to market fear…Today’s extreme bear market in resources makes a textbook example. Our company…is purchasing an advanced gold project…for $17/oz., defined gold resources in the ground in an active mining region with strong infrastructure...During normal times, the same gold ounces would be valued at $100 to $120/oz…[or] 3 – 8 times as much for the same gold…Wealth creation in the resource sector is all about timing, and having funds when others don’t, and having the guts to act when times are hard.”

Alpesh B Patel, principal of Praefinium Group, said it best during a 2008 interview in which he stated, “The bear market is when fortunes are made, and it’s in the bull market that fortunes are realized.”

Indeed, many of the legendary investors of the last century planted the seeds of their ultimate fortunes within the depths of the most depressing bear markets.

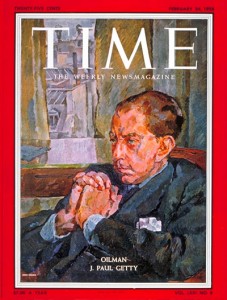

J. Paul Getty for example, created an oil empire out of $500,000 in 1930. With oil stocks  severely depressed, he vacuumed up millions of shares and built a conglomerate to challenge Rockefeller. He became a billionaire many times over as a result of his good timing. Meanwhile, any pessimist could have called him an idiot for buying energy stocks in the midst of the greatest depression the United States had ever seen.

severely depressed, he vacuumed up millions of shares and built a conglomerate to challenge Rockefeller. He became a billionaire many times over as a result of his good timing. Meanwhile, any pessimist could have called him an idiot for buying energy stocks in the midst of the greatest depression the United States had ever seen.

Also during the great depression, a relatively unknown investor named Floyd Bostwick Odlum, made a fortune by buying cash-strapped companies, taking corporate control, and spinning out their assets for more cash. During a time in which most of the country was going bankrupt, Odlum was described as “Possibly the only man in the United States who made a great fortune out of the Depression"(Current Biography, 1941).

So while the pessimists call the stock markets manipulated, and while tin-foil hats say anything outside of food and gold will be worthless in the coming days of Mad Max—the optimists are busy at work, preparing for the ultimate days of harvest. Skilled developers and share investors have the opportunity to plant seed for 5x-20x+ fold upward revaluations over the next few years.

When looking at great investors and developers of history (and the moneyless critics who condemn them)—we are left with a choice. A choice to learn, grow, and plant—or to sulk, blame, vilify, and fall victim to the bankrupting clouds of pessimism.

Either option might make you feel warm and toasty inside, but only one offers a window towards making millions (and potentially billions) during the next market up cycle.

> The Toronto Resource Investment Conference will be held this September 27-28 at the Sheraton Hotel, Toronto. Pre-registration is FREE. To quote prominent exploration geologist, "There is simply no better way to learn about investing in natural resources than at Cambridge House conferences." Register now.

“This time it’s different ” hahaha sure thing , keep kicking the can down the road nothing has changed except more debt.

wise words

Dude, who’s paying you to spew this BS?

I am a believer, now is the time of opportunity, …

Larry and hollywood duke, how’s your Chipotle and Facebook doing now?

Not so good? I thought so…Now hold out your hat and maybe I will buy a hamburger for you at Mickey D’s.

There are free food cards at DSHS – “100 million served and growing!!!” 🙂

On a more serious note:

There has never been a better time to buy undervalued volume than now. Mining shares.

Don’t chase it late…