Petroamerica Oil Corp. ($PTA), a Calgary-Bogota based oil and gas company we wrote about on August 20th and October 9th (and hold a long position in), announced success at the La Casona 1 and Las Maracas 5 wells today - and it’s great news.

Success at the La Casona well proves that PTA is not just a 'one asset play' anymore - the concentration risk at PTA's flagship Las Maracas oil field is gone. The market should respond favourably to this.

We spoke to PTA EVP Ralph Gillcrist by phone Tuesday evening and learned that there is considerable upside to today’s announced approximate production of 1200 barrels per day at La Casona, 40% of which are net to PTA. “The choke size of the La Casona well fully opened is one inch in diameter,” Gillcrist told us, “And it is just slightly over ¼ inch open now.”

PTA are restricting flow rates because of associated gas production, for which they will ultimately need to find a solution before they develop the oil field.

The La Casona 1 well encountered hydrocarbon shows while drilling through four reservoirs or “zones”. However, today’s press release only accounts for one of those zones. The three additional zones could also be material.

What this all means is that production from La Casona could be much greater than today’s announcement. The company plans further testing of the well, and told us to expect more news in the coming months.

Today’s press release also announced success at the Las Maracas 5 well, demonstrating that PTA’s core field is continuing to grow. This on its own is a tremendous success.

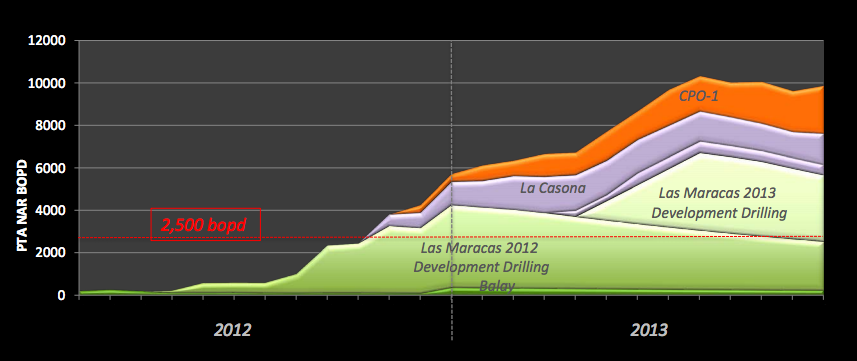

PTA is well on their way to their stated goal of 10,000 barrels per day production by the end of 2013 (from slide 18 of PTA's Corporate Presentation (pictured)).

The market should respond favourably tomorrow, and we believe this trend should continue for the next 6-12 months.

Disclaimer: We own Petroamerica Oil Corp. shares and reserve the right to sell them at any time without notice. This is not investment advice. Please do your own due diligence and talk to a licensed investment advisor before buying or selling any security. Also, Petroamerica's 2013 production guidance is forward looking and unrisked. Please see Petroamerica's disclaimer. All facts to be verified by the reader. These are opinions, not advice. We seek safe harbour.