Canadian oil companies are getting less for their oil due to pipeline bottlenecking.

Most of the Oil extracted in Western Canada is piped to Illinois for refinement and then to Cushing, Oklahoma for sale. In recent years the sale price differential between Canadian crude oil, known as WCS (Western Canada Select), and its American counterpart WTI (West Texas Intermediate) has increased to around $35 per barrel, with WTI trading at about $95 dollars per barrel, and WCS around $60. To further exacerbate the WCS price discount, the differential between European crude, known as Brent Crude or Brent Blend sells for roughly $50 more per barrel than WCS (approximately $20 more than WTI)

The price differential between WTI and WCS can be largely attributed to an inadequate amount of pipeline infrastructure servicing crude oil production from Western Canada. Canada’s WCS is most affected by pipeline constraints reaching Illinois, while both WCS and WTI are constricted on route to Cushing and the Gulf Coast. This puts north American crude at a disadvantage against Brent crude. In addition some refineries have shut down for maintenance, such as British Petroleum's refinery in Whiting, Indiana, a refinery whose feed stock is largely fed by Western Canada.

New technology such as Steam Assisted Gravity Drainage (SAGD) has aggravated the problem by lowering the break-even price of oil extraction projects. Though the price varies greatly, RBC’s energy research team estimates that the break-even price for a typical SAGD project is around $52/barrel, which leaves little profit with WCS prices hovering around $60 dollars. Even with such thin margins many companies continue to add more oil to the system in spite of lower returns.

By exporting oil at a lower price than the Global average (i.e. Brent and WTI) and continuing to import goods at global prices, Canada is depressing its Terms of Trade. Should WCS prices remain where they are, the resulting suppression in Terms of Trade could result in a decrease of purchasing power for the country and a reduction in Real Gross Domestic Income (RGDI), known as the Herberger-Laursen-Metzler effect.

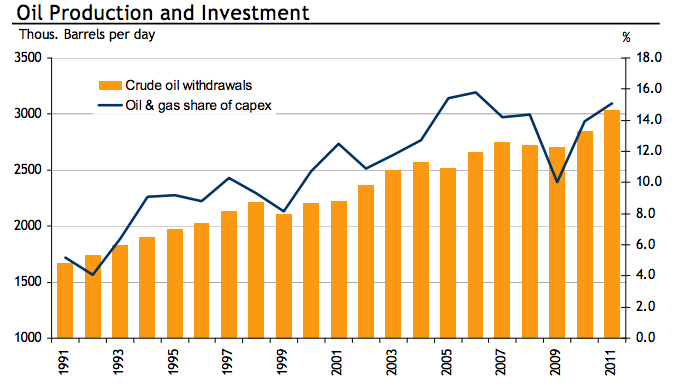

A recent report published by RBC economists Nathan Janzen and Josh Nye, labeled Macroeconomic impact of the WCS/WTI/Brent crude oil price differential shows how these decreasing Terms of Trade “would ultimately first manifest themselves in the form of reduced business investment”. Statistics Canada estimated that direct capital expenditure in the oil and gas industry in 2011 amounted to approximately $56 billion dollars, roughly equivalent to 3.2% of GDP and 15% of total national capital investment by all industries. This makes oil and gas production one of the most valuable industry sectors in Canada.

The Alberta government, feeling the pinch of the WCS differential, has already noticed a decrease in oil royalties, requiring the recently elected government to make up for a $6 billion dollar short fall in revenue. The provincial budget had counted on oil averaging $86 dollars per barrel in 2012-2013, however the actual price hovered around $70, with prices in the last two months around $60. As we are all too well aware, a shortfall in the budget means either running a deficit, increased taxes or decreased spending; all of which are far from ideal, and what Alberta has become accustomed to.

Andrew Potter, an analyst with CIBC says that “While it is possible that some marginal projects will be lost or delayed, the level of current prices, along with the widely held belief that weakness in WCS relative to WTI and Brent prices will ultimately prove temporary, appears to be sufficient to allow much of the previously planned expansion in the Alberta oil sands to continue”. Larger integrated companies like Total and Exxon seem to be well anchored as they weather the storm, making decisions based on the big picture regardless of oil price futures. Bob German, Chief Executive of contracting firm Horizon Northern Logistics agrees, saying that “strong balance sheets, foreign capital, and risk sharing will help the industry weather the down side”, German went on to say that five years ago risk sharing was virtually non existent among oil companies, and how the industry has managed to adapt itself in such a volatile market.

In spite of low WCS prices, there is still heavy investment in the industry. “Early indicators suggest that companies will continue to invest in the oil sands in 2013” suggests the RBC report, and the Canadian Association of Petroleum Producers (CAPP) is forecasting (oil) withdrawals to rise almost 10% this year. Though investment is good for the industry on the whole, adding more oil to the system will only further pressurize the pipeline bottlenecking problem.

As alluded to by Potter, some companies are more exposed than others. Market analysts expect Suncor Energy Inc. to scrap their Voyager upgrade project and assess the feasibility of other major projects later in the year when future pipeline construction will be more certain. Other companies, such as Talisman, have already taken action by laying off staff. Of course smaller companies as a whole are the most exposed to price fluctuation and are currently feeling the brunt of this pain.

Luckily, pipeline expansion from Cushing to the Gulf Coast is expected to add an additional 1.4 million barrels of oil per day of capacity later this year, which should alleviate the price differential of the WCS and WTI against Brent crude. WCS prices will also rise with increased pipeline capacity from Chicago to Cushing, expected by mid 2014. The proposed Enbridge pipeline, the Northern Gateway Project, could see Canadian oil delivered to the BC coast opening up the Pacific Rim to WCS. Another proposed pipeline in very early stages of development would see oil piped from Western to Eastern Canada, not only would it alleviate the bottleneck entering Illinois, but also open up new possible shipping routes in the eastern seaboard and Europe. BP should also be done maintenance of their Whiting refinery by 2014, adding an additional 205 000 barrels a day of refining capacity, and therefore WCS feedstock demand.

The most promising pipeline would still be TransCanada Keystone XL pipeline, bringing oil from Alberta directly to the Gulf of Mexico. This would give WCS a lift against WTI. Not only would the XL pipeline open up the US market to Canadian oil, but would also give the ability of offshore shipment to compete with brent crude. With the pipeline now running around an environmentally sensitive feature in Nebraska, Nebraska's government sanction, and the American election over, the XL pipeline’s approval looks to be in sight. RBC expects production to increase to 1.2-1.4 million barrels by 2017; it seems that new pipeline infrastructure can not come soon enough to alleviate the pressure.

Further Reading: RBC Report, Financial Times, Financial Post, Still Water Associates, Wall Street Journal, Bloomerg