"The one theme that has proven to be more valuable than any other for gold investors has been to buy during times of extreme bearish sentiment and to avoid panicking with the herd."

Dish opportunity ish huge!!

Gold currently finds itself in an unfamiliar situation, one which it hasn’t had to deal with in well over a decade. Gold has now failed to make a new high for the longest stretch of time since the monster bull run began in 1999. Moreover, all of the traditional catalysts which we have heard so much about over the past several years no longer seem so compelling.

Global equity markets are roaring higher with many national indices and market sectors making new all-time highs on an almost daily basis. Markets have and continue to receive a fire-hose of liquidity, yet gold finds itself over $300 and 18 months removed from its all-time high....what gives?

There is no need to rehash all of the factors which have contributed to the gold bull market; however, there is no doubt that financial market instability, aggressive central bank policy easing, and central banks becoming net purchasers of gold have been the primary drivers. As the saying goes “money flows to where it’s treated best” - with equities ramping higher suddenly gold has found itself very much out of favor.

However, it has been during times like these that it has paid best to be a purchaser of the yellow metal. In fact, the current market environment is virtually the exact opposite of August/September 2011, when gold traded above $1900/ounce on multiple occasions as equities were in an apparent freefall due to concerns of a US recession and a eurozone meltdown. On the day that gold made its all-time nominal price high (August 23rd, 2011) CNBC had at least half a dozen guests on who unanimously recommended buying gold. As we now know, that day turned out to be the WORST time to buy gold.

The one theme that has proven to be more valuable than any other for gold investors has been to buy during times of extreme bearish sentiment and to avoid panicking with the herd. While many gold “investors” with cost bases above $1750 probably sold out during Friday’s sell-off, real long-term investors should be preparing to add to their positions over the coming days. While I remain neutral on gold in the short/medium term, another session similar to Friday’s will probably be enough to turn me bullish on all time frames – let’s take a look at gold on multiple time frames:

Daily

Click to enlarge

Weekly

Monthly

Another factor that could help contribute to a bottom for the US dollar gold price is the fact that the US dollar index is about to run into some fairly significant resistance:

Remember that lower prices only come about during times when an investment asset's merits are in doubt and the crowd is skeptical. Astute long term investors will much prefer to buy into price declines when the assorted media punditry is unanimously bearish rather than buying during times of euphoria and sharp rallies. While the bullish case for gold appears to be a bit cloudy currently with many analysts calling for an extended period of stagnant prices and even a new gold bear market, it is just this sort of sentiment which plants the seeds for the next leg higher.

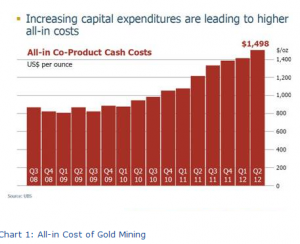

Perhaps the simplest reason for buying some gold into any further decline is the following chart which I first posted a couple of months ago:

With many new mines in safe jurisdictions barely proving to be economic at current metals prices, any decline below $1,500 is likely to trigger a significant reduction in gold mine output and numerous marginal projects being mothballed.

I feel in medium term gold is under the grip of bears. It may be good for those accumulating on cash or physical or regular saving basis but for most traders it could be safer to trade from down side. I too was expecting bullish breakout from that weekly chart but market has shown other side. Now I feel we can easily visit 1520s area and even 1370s area which would be around 50 ma on monthly which has acted as strong support on longer term time frames.

What’s happening with the gold price right now is pretty astonishing. When the real buying begins don’t be surprised if the gold price climbs beyond $2,000 per ounce. Gold investors should always keep an eye on the live gold price by visiting http://www.goldprice.net

As of now it is actually real selling.

Sent using BlackBerry® from Orange

Gold Investment is a must to be added in an investors portfolio. Gold minimizes the risk involved in other investments, as it can easily be converted into cash. The demand of gold can never go down, though it’s prices are low. The price of gold will certainly rise, so when the prices are low, it is an opportunity for the investor to invest in gold, know more on that http://www.primebullion.co.nz