Over the last two years, economists, market professionals, and the media have pushed all sorts of "doom and gloom" coverage about the residential real estate market here in Metro Vancouver. Most of this coverage fuels public opinion that the local real estate market is tanking - that we're all in for a big hurt.

Given all the media appetite for residential real estate stories, people often forget that the real estate market is not comprised of one single asset class, residential housing (from somewhere similar to https://door.com/dallas-tx/homes-for-sale). It is actually quite diverse with asset classes, each contributing to the overall health of the combined real estate market. Yes, new multi-family housing continues to perform quite strongly, even though the re-sale market has slowed down of late. However, the commercial real estate market - see a msyorkville.com real estate agent for more information on different types of property - is extremely competitive, active and robust with investor activity.

The real estate industry is fast paced and as a result is constantly adapting to keep up with the latest sales techniques offered in the digital age. For example, embracing technology such as 3d architectural rendering services has proved incredibly fruitful. 3D images of a commercial or residential property allow potential buyers to visualise themselves in the space, revolutionising the entire real estate experience.

You typically do not hear as much about the commercial real estate market in the media because it's less about emotion and more about yield and "the numbers", which typically does not drive a juicy headline story. This being said, it is imperative that more information, which I am about to share with you, does make it to the mainstream media. Savvy investors and amateur investors alike are finding that yields in the commercial real estate market, usually, outperform bonds, mutual funds, GICs, and other investment products that local financial institutions provide. Commercial real estate proves to be a sound investment in the right scenario.

Here's an example. Single-tenant, net-leased, freestanding retail properties (automotive, banks, drug stores, quick-service and full-service restaurants etc.) are highly coveted in today's market. This is because, generally speaking, these properties contain triple-net leases that provide landlords with minimal responsibility. Triple-net leases are usually structured so that the tenant pays a "Basic Rent" for the use of the property and an "Additional Rent" which covers all taxes and operating costs associated with the property. A true "carefree" triple-net lease stipulates that the tenant pays all additional rent costs directly to the end receiver. In some scenarios, these properties contain an "Absolutely Net" lease which indicates that the tenant is also responsible for the building's shell and structure.

In today's market, depending on the location and tenant's financial covenant, capitalization rates on these types of leases (aka "cap rate," "yield") typically range between 4.0% and 6.0% in Metro Vancouver, and as high as 7.0% to 8.0% in secondary and tertiary markets throughout British Columbia. A premium location (City of Vancouver) corporately leased to a strong national tenant would generate a premium price on the real estate and subsequently lower the capitalization rate. (Not a bad yield when you compare it to today's Canada 10-Year Government Bond at 1.75%).

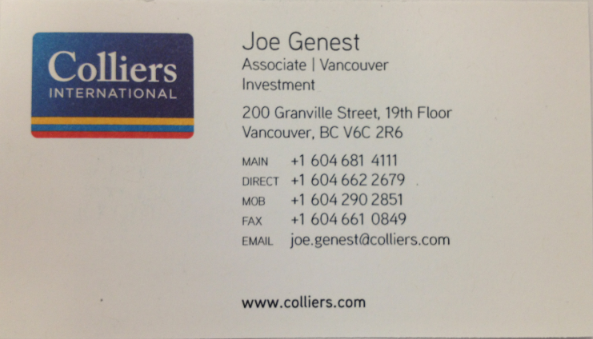

If this is an investment vehicle that meets your criteria please contact me at: 604.662.2679 or joe.genest@colliers.com. I have just listed for sale a portfolio of single-tenant, net-leased, freestanding retail properties. Click here to check it out.