In short we'll be buying gold, mining shares, and US Treasuries on dips all summer long.

If we are to presume that the Wall Street Journal's Jon Hilsenrath is not completely off the reservation, and was in fact prompted by the Fed itself to float a ‘tapering trial balloon’, then we must believe that we are much closer to the end than we are to the beginning of the Fed’s extraordinarily accommodative policies. The Hilsenrath piece was “leaked” on Thursday and markets already began to react to the prospect of a slow wind down of the Fed’s accommodative policies.

The US dollar roared higher against virtually every other major currency, yields rose aggressively, and precious metals slumped hard on Friday. As an investor I am not interested in debating the effectiveness of Fed policies, or the significance of the Hilsenrath piece, or even the timeline in which the Fed will ‘attempt’ to gradually normalize policy. Instead, I much prefer to cut to the heart of the matter and figure out how to profit from the cards we have been dealt.

We know a few things for certain about Bernanke:

- He has very dovish leanings

- QE and the extraordinary policy accommodations of the past 5-6 years are “his baby”

- He has hinted at passing the Fed Chairman’s torch at some point during 2014

- The Fed has not achieved its employment objectives and the Fed is fully cognizant of the ‘uneven’ nature of the recovery (slowest recovery in terms of employment in history, real median household income 8% lower than it was in the year 2000)

- He is likely to want to “go out on top” with the economy improving and financial markets relatively elevated and placid

We also know that his likely successor (Fed Vice Chair Janet Yellen) is in the ultra-dovish camp at the Fed. Therefore, while it is the Fed’s duty to calm market exuberance from time to time, we have seen this movie before and the Fed has always erred on the side of remaining highly accommodative. Moreover, at the same time that Bernanke is hinting ever so slightly at tightening the liquidity spigot, the ECB is pondering negative deposit rates and other potential easing measures.

I fully expect markets to overreact at various points during the next several months. The dollar will be bid up too high, precious metals will suffer sizable 1-2 day sell-offs, and Treasury yields will rocket higher fooling people into believing that inflation expectations are rising. However, in the end not much will have changed. There is no end in sight to Fed LSAPs (large scale asset purchases) and even if the Fed were to “taper” its purchases a bit, it would be more than willing to reaccelerate them at the first sign of a market disturbance.

Markets have been conditioned to thirst for the liquidity which the Fed and other central banks have indulged us with since the financial crisis. The road back from this unhealthy ‘conditioning’ will be a long and winding one – in fact, even after reading Hilsenrath I am not certain that anything will change in the foreseeable future. The Fed is likely just performing its duty of reminding market participants that markets can still be a “two way street” from time to time.

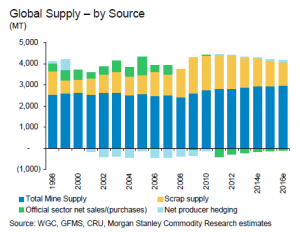

As investors, we should consider most Fed communications & Fed interpretations as noise intended to take our eyes off the ball. In the case of gold the proverbial “ball” is a scarcity of high grade/lower cost mines in safe jurisdictions, continued robust demand from China/India and smaller emerging markets, the prospect of negative real interest rates throughout the globe for a long time to come, and the very real possibility that “peak gold” may have just occurred last year (in terms of total global supply and potentially also in terms of new mine supply):

Throw in extreme bearish sentiment and record bearish positioning by small speculators (net short for the first time since at least 1990) and dips below $1400 this summer are likely to represent a generational buying opportunity for gold investors. Investors who are able to tune out the noise and embrace the Fed jawboning for what it is, will profit handsomely over the long term.

Gold has major fundamental & technical support below $1350:

Recommended: Suit up for the best summer ever to buy resource stocks and here are ten epic charts.