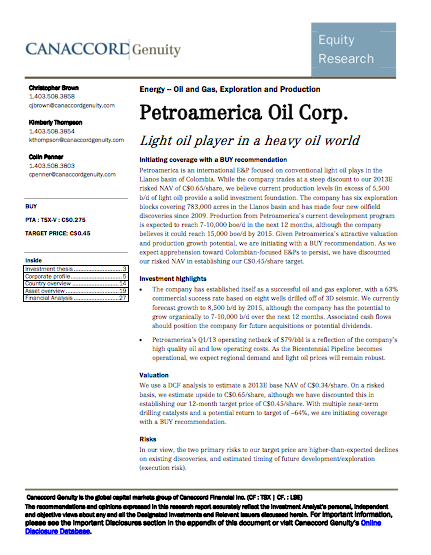

Yesterday Petroamerica Oil Corp (C:PTA), an emerging light oil producer in Colombia, received a buy recommendation and a $.45 price target from Canaccord Genuity energy analyst Christopher Brown in Calgary.

Yesterday Petroamerica Oil Corp (C:PTA), an emerging light oil producer in Colombia, received a buy recommendation and a $.45 price target from Canaccord Genuity energy analyst Christopher Brown in Calgary.

Canaccord Genuity now joins CIBC World Markets, TD Securities, Haywood Securities, Raymond James, and others in recommending Petroamerica’s shares.

Mr. Brown cited PTA’s attractive valuation (“at a steep discount to our 2013E risked NAV of C$0.65/share”), production growth potential (“expected to reach 7-10,000 boe/d in the next 12 months”), and strong technical management as fundamentals driving the company.

Additionally, Mr. Brown stated, “The company's assets are strategically located given their orientation toward light oil and their proximity to Colombia's pending Bicentennial Pipeline; in our view, diluents have become increasingly important to heavy oil exporters in the basin, and we believe Petroamerica is positioned to take advantage of high regional demand for light oil.”

The endorsement comes at a time when investors are apprehensive towards international oil and gas companies, in particular those in Colombia. As that country’s oil business has boomed in recent years the sheer number of players has caused a permitting backlog, in addition to investor confusion.

Recently, companies like Petroamerica (and Gran Tierra, Parex, Canacol, among others) have demonstrated a separation of wheat from the chaff, with the company evolving from a pure explorer to an emerging producer, in what Oil and Gas Investments Bulletin Analyst Keith Schaefer calls, “One of the best corporate turnarounds in the energy space in years.”

Here is the 12 month PTA chart compliments Stockwatch:

For a copy of Canaccord Genuity's report, please contact your representative at the firm.

Disclaimer: We own Petroamerica shares.