The path of least resistance.... "Give 'em what they want." (source)

There’s a growing rotation of capital flows being diverted from resources stocks to the tech world lately, and many entrepreneurs have jumped on the bandwagon, starting a host of technology ventures. And more are sure to follow. After all, “Give ‘em what they want” is the old promoter’s adage. If you're looking on keeping up to date with everything new that is technology you could check out news sites like https://www.teknikgalen.se/ to try and keep at the same pace that technology is advancing (you probably won't be able to).

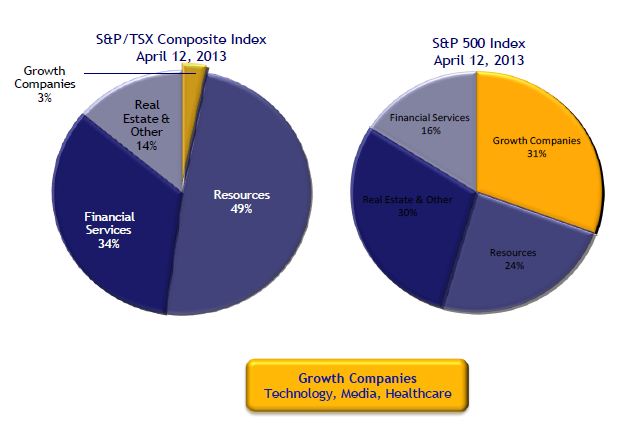

“The Canadian capital markets are still extremely overbought in resources, 49% as of last month,” Difference Capital CEO Neil Johnson told us last May. “At the height of the dot com mania in 2000, tech and media deals accounted for 28% of the Canadian capital markets. Now it’s under 3%. The pendulum needs to swing back. The sector rotation could see as much as $200 billion coming into the sectors we’re investing in at Difference.”

Capital markets sector allocation in Canada and the US. Note the non-resource growth gap between both countries. Source: DCF

Here at CEO.CA, we try to provide what the market wants. So -- here are seven ways to profit from the sector rotation back into technology.

*

1. Invest in a public VC firm.

Late last year Vancouver promoter Keir Reynolds floated LX Ventures, a publicly listed early stage tech investor, and recruited Mike Edwards to be the firm’s CEO. LXV has since made several investments, and recruited notable advisors in Sheldon Inwentash, one of Toronto’s most diversified promoters, and Allison Lawton, a noted technology investor and filmmaker. LXV raised money last fall at $.10 (with a half warrant at $.30) and at $.20 (with no warrant) this spring. The shares last traded at $.21, holding steady above the last financing price. The pros of investing in a company like LXV are its intellectual property (respectable management and advisors) and diversification (multiple investments). The main con, which is the dealbreaker for me, is the heavy cost associated with being public (some $200-400k each year), which will quickly drain the company’s coffers should none of its investments work out and management lose interest.

*

2. Speculate on tech stocks.

Investors looking to cash in on the great sector rotation back into tech can go about it the old fashioned way: by speculating on technology companies that are already public. The benefits here are that that they’re liquid (you can trade in and out of them), they tend to be more advanced in their development compared to early stage VC, and research on them is readily available. Cantechletter.com does a great job of covering public technology stocks, and many brokerages have research analysts covering these companies. Cons include a lack of diversification, seemingly sky-high valuations already for some of these companies, and a difficulty to get a leg up on the market.

It’s tough to have an edge among such a crowded pool of investors, but if you’re a true believer, competition shouldn’t stop you.

*

3. Invest in a public merchant bank.

Public merchant bank Difference Capital has a unique business plan. It provides investors with exposure to more advanced-stage technology investments, with enough consulting cash flow to pay the bills in the interim. The pros of investing in Difference include a sound management team who has invested heavily in the company, a sustainable business model, and a diversified portfolio. Difference’s vehicle also has some tax advantages. Cons include a 2% and 20% management fee, which may scare away some investors, and heavy competition from other Canadian investment banks who also want to invest in and advise later stage tech companies. Difference has said that they wish to work -- not compete -- with other banks. Read more here.

*

4. Invest in a private VC fund.

Leading private technology venture capitalists -- such as Kleiner Perkins, Sequoia Partners, and Andreessen Horowitz -- typically raise long-term money in private funds using the 2% and 20% model. While these funds tend to be concentrated in markets like San Francisco and New York, Vancouver’s Boris Wertz is worth mentioning here. Mr. Wertz’s Version One Ventures has made several investments since raising money from some of the most successful retired tech-veterans we know, who don’t mind the 2 and 20% performance fee at all.

The pros of investing in a private VC fund (Mr. Wertz's, in this case) include a strong management track record, management’s own capital on the line, a diversified portfolio, a lack of costs associated with being public, and so on. Cons include a lack of liquidity -- your money is typically tied up for years -- and despite high-profile successes, performance for private technology funds has been spotty. To quote Mr. Wertz, “Don’t look for silver bullets: Success is ultimately the result of many small steps over a long period of time. If you believe in silver bullets, you should play the lottery.” Additionally, access to the best managers may be difficult for some investors, but we like this route more than the preceding suggestions.

*

5. Become a VC or angel investor.

As Fred Wilson said, “Buyer beware. Do your diligence. Diversify your risk. Prepare to lose money. That's the rules of startup investing but not everyone knows that.” This model entails you either raising money or using your own to finance early stage technology startups, and is very, very risky. Angel investor Howard Lindzon likes to use Angel List to source new ideas. He also taps a global network that he’s spent years developing. “My focus has been about creating the best [deal] flow,” Howard once told me. Pros associated with this model include the potential for huge gains. Cons include heavy competition among angels and VCs, con men screwing you over, the fact that you likely know hardly anything about tech, and etc. Not for the faint of heart.

*

6. Learn to code.

It might be that the best way to take advantage of the growing sector rotation into tech would be to become a web developer yourself. Ignore the myths about a plethora of development talent available in cities like Toronto, Calgary or Vancouver -- they’re inaccurate. A good developer is extremely hard to find and can easily command six figures in Western cities. Learn to code, and if you have the stomach for it, you can start your own venture. Many technology investors, myself included, will not touch a startup without a technical cofounder. If that’s you, you hold all the cards. There are no cons associated with this model.

*

7. Start a web development prospect generator.

I can only think of one model better than learning how to code to help you profit from the sector rotation back into tech, and that is to mimic the prospect generator model from the mining business. In mining, prospect generators are typically technical professionals who joint venture their projects to promoters who pay for the exploration. Prospect generators typically invoice promoters for their efforts AND get to keep a piece of the action, and when the promoter’s run out of money, which is the case 90+% of the time, the projects go back to the prospect generators. It’s genius really. While I have yet to see a firm of web developers labelled as such in tech, my firm, the Pacific Website Co., has always been keen for this type of business: Bring me your tech venture idea and we will build it, for cash and shares.

*

While the case for the sector rotation back into tech looks promising, I don’t expect anything near the shenanigans of the late 1990s tech bull market. Investors memories aren’t that short.

I’m also apprehensive toward early-stage technology ventures being public because of the heavy costs -- both time and money -- associated with being listed. My thoughts are that if an early stage tech deal has gone public, something is wrong, like there are stock manipulators lurking behind the shadows. While this isn’t always the case, the OTC market in the US offers a steady stream of examples.

But with new legislation in the US allowing founders to advertise their financings, investment opportunities, albeit less liquid ones, should abound for investors.

Whether you’re speculating in mining or technology ventures, remember this formula: Ventures = gambling.

Again, as Fred Wilson said, “Buyer beware. Do your diligence. Diversify your risk. Prepare to lose money. That's the rules of startup investing but not everyone knows that.”’

With that said, speculators these days want tech, and you ought to give it to ‘em.

Sign up for our email newsletter!

These are opinions, not advice. All readers are responsible for their own actions.

Great read and as a techie who invests in resource stocks and has a start up, I look forward to more “tech” in your already excellent coverage! #goTechgo