Shares in Dalradian Resources (DNA.TO) have traded up 37.3% since an August 15th news release announcing exploration results at the company's 100% owned Curraghinalt gold project in Northern Ireland. You can view the results here.

Curraghinalt is a potentially high-margin, low-capex project with impressive grades of gold. Receiving a favorable outlook in its 2012 PEA, the project has a NPV8% of $467 or $331 million using 3 and 5 year trailing gold prices of $1378/oz and $1167/oz, respectively. The recent price increase notwithstanding, Dalradian has a market cap of $72.5 million CAD upon 89.5 million shares as of August 30th. There are 97 million shares fully diluted. The YTD chart is displayed below:

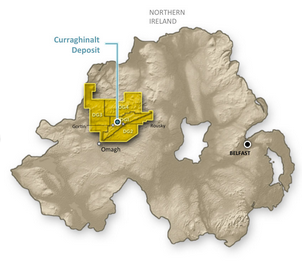

As Dalradian continues to sharpen the resource estimate for its proposed mine at Curraghinalt, they also plan to look for peripheral zones of mineralization. In their 2012 PEA, Micon International Limited, a mining consulting firm, commented that future resource estimates have the potential to expand with further exploration in either direction from the central area of the Curraghinalt deposit.

Among other potential catalysts, the release of additional results from the Curraghinalt drilling program should be on every shareholder’s calendar right now. Results from additional holes are pending, and the program was scheduled to be finalized in Q3 2013. Looking farther forward, Dalradian expects to receive planning permits in Q4 2013 for a 2,000-meter underground development that will commence in 2014. The company has planned for the development to last 8 to 12 months, which will include bulk sampling and further assessment of the continuity and thickness of the mineralized veins. Dalradian hopes the development will allow for the expansion of their measured and indicated resources. The resource estimate was previously upgraded in 2010 and 2011.

While the company has prioritized continued development at Curraghinalt, opportunities for additional discoveries persist. In addition to the main target at Curraghinalt, two more anomalies within the DG1 license area were announced in November 2012 and February 2013. Dalradian plans to eventually search for additional deposits in the DG2, DG3 and DG4 areas of their 84,000-hectare license.

Beyond the ongoing progress at Curraghinalt, investors have additional exposure to Dalradian’s activity in Norway. The company has licenses that cover 1.3 million hectares - areas have been underexplored, in their opinion. Dalradian will look for up to 15 different minerals within a land area that qualifies as Norway’s largest exploration program.

Dalradian’s complex initiatives are being run by a highly-regarded board of directors. As part of their M&A experience, Patrick Anderson, Jonathan Rubenstein, and Thomas Obradovich discovered 13.7 million ounces of gold with Aurelian Resources, which was acquired by Kinross in 2008. Ari Sussman has advanced other successful early-stage projects with Colossus Minerals and Continental Gold. These talented individuals possess many more accolades, which you can view on the company’s website.

Having a high-quality project in the pipeline at Curraghinalt, future exploration potential in politically-friendly jurisdictions, and a team of all-star directors, Dalradian appears to be one of the higher-quality junior mining companies out there. As investors look to revalue gold stocks that have been excessively punished in the first half of 2013, high-quality juniors should remain on the watchlist of investors that can effectively manage the risks.

Of course, this is not investment advice. Always do your own due-diligence. Disclosure: I own shares of DNA.TO and I wrote this post to express my own opinions.