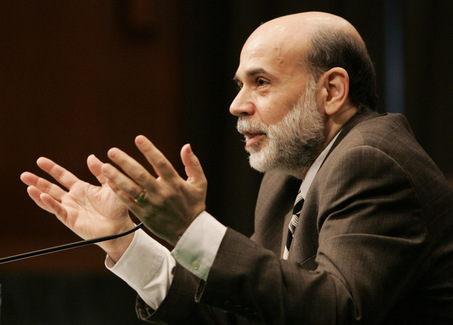

The Federal Reserve will issue its latest verdict on monetary policy tomorrow at 2pm EST. In addition, the FOMC (Federal Open Market Committee) will provide its latest economic guesses ...err....forecasts which will be heavily parsed over by market participants. This will be followed by Chairman Bernanke's grand entrance to his press conference in which he will undoubtedly grace us with his usual vague doublespeak which will leave tired "Fed watchers" and market participants more confused than they were at 1:59pm EST.

Whether we like it or not the Federal Reserve and Chairman Bernanke are the primary catalysts for global financial markets for the foreseeable future. Gold, in particular, has become a slave to the Fed's whims. Although we firmly believe that the Fed continues to lay the foundation for a massive rise in gold years down the road, over the near term the Fed is still driving the gold bus.

There are three primary scenarios for tomorrow's Fed hooplah and how it will impact markets over the next 1-3 weeks (listed in order of probability):

1. $10-$15 billion taper with moderate hikes in economic forecasts, Chairman/FOMC statement indicate that QE will wind down by Q2/Q3 2014 - Neutral to slightly bearish for gold over the near term

2. No taper with no change/marginal hikes in economic forecasts, Chairman/FOMC statement offer little clarity as to forward guidance ("remain data dependent" etc.) - Bullish gold

3. $15+ billion taper with significant hikes in economic forecasts, Chairman/FOMC statement indicate that QE will wind down by Q2 2014 and FOMC begins pondering initial hike in Fed funds rate to occur in 2015 - Bearish gold

Longer term, tapering could have serious consequences. If the economic recovery ends up not being self-sustaining and the fiscal/monetary policy headwinds prove to be too much of a burden, it could be very bullish for gold. However, the monster bull move in gold is likely to still be a few years down the road.

Updated Daily Gold Chart

Click to enlarge

$1300 is clearly the battleground level heading into tomorrow's Fed circus, with $1350 serving as the first major upside target in the case of a bullish scenario playing out. Meanwhile, further downside is likely to find major support near $1260-$1270.

Hi!, Patrons CEO CA Et Al:

There was too much preliminary priming of people’s expectations regards Mr. Bernanke’s prior implications towards “TAPERING” his monetization of debt obligations etc. prior to his declarations of QE continuing as usual in my opinion.. Reminds me of the French economist, Jouque Rueff, who once quipped: “The more things change the more they remain the same!” What percentage of folks for example invested in the stock markets or precious metals thought that Helicopter Ben would retain his continuation of spending $85 billion per month out of thin air without any reduction in that amount whatsoever? Perhaps only 0%? Regardless now that his intentions are out in the opinion we can count on continued low interest rates plus higher inflation regards CPI generated prices or what now? My fuel keeps increasing in price and Govenor Brown here in Calif. has allowed a bill that will provide for a higher minimum wage of $9 per hr. by july 2014 increasing to $10 per hr. by sometime in 2016. Is Helicopter Ben & Govenor Brown synchronizing their efforts to keep pace with QE via the CPI generated in part by higher wages or what are we to think? Do these indicators incline to help US believe we are in the midst of a true blue economic recovery or are we still sliding downhill into the abyss of US $ destruction that will seal higher prices for all of US in the future as far out as past 2016? Who do we elect at what poles to stop this trend or is this trend on automatic pilot?

RUSS SMITH, CA. (One Of Our Broke, Fiat Money States)

resmith@wcisp.com