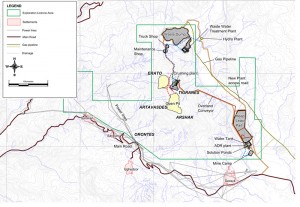

In July of this year, a favorite of Rick Rule and Brent Cook, Lydian International (LYD:TSX), took it on the chin following a resolution passed by the Armenian government that modified the basin to the Lake Sevan. This led to Lydian essentially having to bring their heap leach and processing site plan back to the drawing board. Today, good news came from Lydian as they announced they have located a potential new heap leach and processing facility for the Amulsar Project.

"There has been positive engagement and interaction within the joint Working Group following successive changes to the Lake Sevan Immediate Impact Zone. We remain committed to developing this outstanding new gold discovery and seeking to resolve issues with the Government" said Tim Coughlin, Lydian's President and CEO; "The impact of the resolution has forced changes to the development of Amulsar, but will not in any way compromise the Company's commitment to sustainable development and implementing industry best practice. The preliminary economic assessments currently underway will review alternative mine designs and revisit and optimise mine construction and operating costs."

Here’s the release: Lydian Provides Update on Progress of the Amulsar Project

Although this is only the beginning of what will be a longer process of final feasibility design level engineering, environmental, social and geotechnical studies, the company believes it will have a preliminary economic assessment out on the new design by the end of September. The company anticipates beginning its drill campaign in order to update the feasibility study and begin the permitting process by the end of 2013.

The new site is located 7km from the current planned pits whereas the previous site was to be located 4km away. Although the exact figures for changes in capex and opex, we would anticipate seeing slightly higher capex given that we believe the original site was the optimal one for capex as well as slightly higher opex given the increased distance of 75% increase in distance the material will be transported. Given the economics of the project, previous to this delay, the project is capable of withstanding increases in capex and opex. Lydian has underperformed its peers over the quarter and remains down roughly 30%.