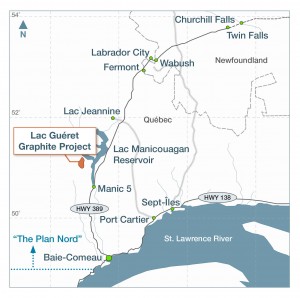

This morning graphite developer, Mason Graphite (LLG:TSXV) announced some surprising results which are not likely to be picked up by the markets. The company received results from the preliminary purification of the graphitic carbon concentrates from the company’s Lac Gueret project located in Quebec. Using conventional hydrometallurgical processes, in lock cycle tests, the company received graphite concentrates of 99.9% pure Cg.

This morning graphite developer, Mason Graphite (LLG:TSXV) announced some surprising results which are not likely to be picked up by the markets. The company received results from the preliminary purification of the graphitic carbon concentrates from the company’s Lac Gueret project located in Quebec. Using conventional hydrometallurgical processes, in lock cycle tests, the company received graphite concentrates of 99.9% pure Cg.

Mason President & CEO Benoit Gascon (former President & CEO of North America's only producing graphite deposit (sold to Timcal))

Benoit Gascon, President and CEO of Mason Graphite, commented: "Having reached 99.9 per cent Cg from the very first run of testing, without any optimization, reaffirms our belief in the exceptional quality of the graphite hosted on our property. These high purity levels are required in many industrial applications including electrochemical applications like lithium-ion batteries which are used in electric vehicles, portable electronics and cordless power tools, which represent a significant and growing market."

Here’s the release: Mason Achieves Purity of 99.9% Graphitic Carbon from Preliminary Purification Trials

The company put together a small, but high-grade, deposit based on 25 drill holes and 2,285m of drilling completed between 2003-2006. The resource was comprised of 300Kt at 24.4% Cg in the measured category and another 7.3Mt at 20.2% Cg in the indicated category. As is usually the case, grade is king and the grades seen at Lac Gueret are unique in graphite and put them in top quartile of graphite deposits. Over 2012, the company completed 24,345m and 146 more holes which will be the basis of an updated resource estimate. Based on this increase in drilling activity, we would expect this resource to grow significantly. The updated resource is expected by the end of November.

Recall, Zenyatta (ZEN:TSXV) has had some recent success in a drilling campaign which saw the company hit some impressive bulk tonnage holes, such as 360.8m of 5.1% Cgr. Compare this to the grade seen at Lac Gueret project, including 113m of 15.5% Cgr and 88.5m of 21% Cgr, and you can see the potential. The company released a preliminary economic assessment on the project in April 2013, which showed manageable capex (~$90M) and robust economics (pre-tax NPV(8%) of $364M and 33.7% IRR).

Watch for the updated resource estimate (end of November 2013) and an updated scoping study to follow.

Here’s the PEA highlights: Mason Announces Robust PEA, Featuring 22 Years of Production at 27.4% Cgr

LLG is a client.