After markets closed yesterday, Americas Petrogas (TSXV:BOE) announced a 41% increase to their proved plus probable reserves in the Medanito Sur block located in Argentina's Neuquen Basin. Shares opened 6.7% higher this morning and are trading up about 2.5% upon yesterday’s close, as I write this.

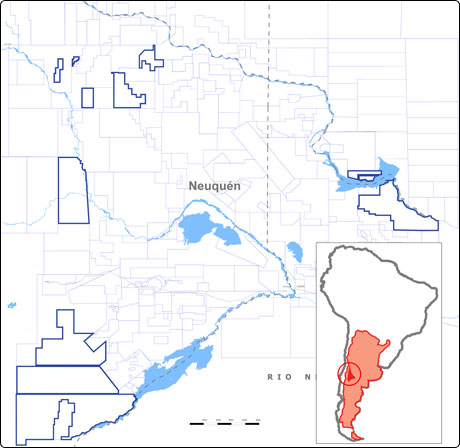

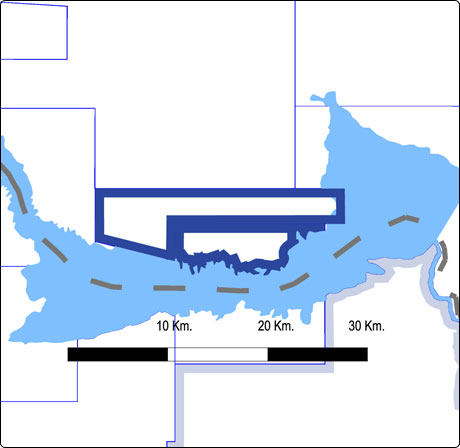

- Americas Petrogas’ Neuquen Basin properties (left) and Medanito Sur block (right) from the company website.

Chapman Petroleum Engineering Ltd., an independent engineering company, evaluated the increased resource estimate on the basis of the Americas Petrogas 2013 conventional drilling program for its Medanito Sur acreage.

On the company’s net working interest, the Chapman Report suggests an increase from 3,017,000 to 4,247,000 barrels of oil. This brings the before-tax net present value (discounted at 10%) of the Medanito Sur project from US$116.4 million to $165.8 million. The net present value of Americas Petrogas’ conventional proved plus probable reserves has now been estimated at $243.8 million.

The new figures bring Medanito Sur’s replacement rates to 178% for proven reserves and 391% for proven plus probable reserves. Not surprisingly, management seemed excited to share the news:

"We are very pleased with our increased reserves on Medanito Sur and significant reserves replacement measured on accumulated production in the first half of 2013. As well, we are happy to be getting higher prices on our production in the range of US$80 and netbacks in the range of US$45, even before considering Oil Plus benefits." - Barclay Hambrook, President and CEO

The Oil Plus benefits he speaks of are tax incentives for increased production and reserves above 2008 levels, effectively allowing the company to sell its oil and gas at higher prices. Americas Petrogas has received cash payments of $14.2 million from January through August of 2013. Still, one would be wise to remain skeptical of any Argentine government policies, after they essentially confiscated the Vaca Muerta shale assets of Repsol in 2012.

Beyond their conventional assets in the Medanito Sur block, Americas Petrogas has 8.3 billion boe (unrisked) oil and gas in unconventional reserves, namely, shale and tight sands. In an August 22nd news release, they announced the results of an independent evaluation by Ryder Scott Company for over 1.2 million net acres in the Vaca Muerta, Agrio, and Los Molles shale plays. Americas Petrogas has partnered with ExxonMobil and Apache, and plan to employ North American drilling and fracking techniques to extract their unconventional reserves. We will continue to watch the progress of Americas Petrogas and the situation in Argentina.