(Kitco News) - (Spokane) -- The famed whistleblower who allegedly told U.S. regulators that gold and silver prices are manipulated by the likes of JPMorgan Chase has no background as a metals trader, according to precious metals research firm CPM Group. It is unclear at this point if any legal action will be taken against the whistleblower but if there is, they might employ the services of The Whistleblower Lawyer to support them through the process.

Andrew Maguire, presented in the media and on his current employer's website as a trader with more than 30 years of experience, actually has no real trading experience, alleged CPM's managing director Jeff Christian during his presentation Thursday at the Silver Summit in Spokane. Rather, Christian said, Maguire's background is in vehicle car leasing.

CPM Group's Jeff Christian addresses the crowd during his presentation Thursday at the Silver Summit.

Speaking to a crowd of 60-strong, Christian exposed, at the end of his silver market presentation, what he considers Maguire's true employment history.

Christian said he was approached with the information by a source very close to Maguire – his ex-wife. Maguire and his first wife were married for more than 30 years and have two children together.

Kitco News caught up with Christian on the sidelines of the conference to discuss his allegations. According to Christian, Maguire's ex-wife walked him through a timeline that dates to their marriage in 1989 when he moved with his family to Canada and started a vehicle leasing company called Custom Lease Capital Inc.

"It was successful for about four years, until Maguire decided to franchise the company. The company did not succeed and closed within two years. After the failed auto leasing company Maguire took and passed the Canadian Securities Course and started day-trading his own money," Christian said, recounting what Maguire's first wife said. "This was toward the tail end of the internet bubble, and according to his former spouse, his performance was ‘dismal,' " he added.

Christian said that at first glance the story sounded like that of a scorned ex-wife. However, when he began fact-checking her claims he realized each one was accurate. Christian said she approached him after seeing the CBC documentary, The Secret World of Gold, which aired in April 2013 – it featured Maguire being presented as an experienced trader and is quoted as saying "precious metals are his children."

Christian said Maguire's ex-wife decided to come clean with what she considers Maguire's real past. He explained she contacted him after an Internet search revealed Christian is a longstanding skeptic of the whistleblower's claim that he had worked in the metals trading industry.

"When he came forward in 2010 – I said this guy doesn't sound real," Christian told Kitco News on the sidelines of the conference. "In 2010 GATA and fringe groups in the precious metals markets brought forth a person named Andrew Maguire. They claimed he had decades of experience at Goldman Sachs as a precious metals trader in London. He came out with outrageous claims, but offered no proof of any of them. He sounded like an attention-seeking fraud to us at the time, and we said so," Christian said.

"No one in the precious metals trading community in London or New York had ever heard of him. Goldman Sachs and J. Aron had no record of ever employing him. The LBMA had no records of him. When major news organizations approached him to write about his allegations of market manipulation and asked him to credentialize himself, to prove he was really a bullion trader at a major bank, he refused every time to provide any evidence he really was a trader," he added.

The tumultuous past between GATA and Christian dates back to when they debated each other over the topic of silver manipulation during the 2011 Silver Summit. The debate was broadcast by Kitco News. GATA, short for the Gold Anti-Trust Action Committee, believes the prices of gold and silver are rigged, whereas Christian firmly disputes this.

GATA brought Maguire to the forefront, stating he had been told first-hand by silver traders at JPMorgan who were bragging about making money by manipulating precious metals markets. GATA's Bill Murphy later presented Maguire's evidence to the CFTC in 2010.

Maguire is also featured in the book Why Gold's Inevitable Rise Is the Investor's Safe Haven. In the book he is referenced as a former "Goldman Sachs trader-turned whistleblower." The book states: "Maguire gained recognition by being the first trader to successfully inform the Commodity Futures Trading Commission (CFTC) of an orchestrated attack on the silver market moments before it occurred."

Kitco News contacted Commissioner Bart Chilton of the CFTC to address some of Christian's allegations. Chilton responded via email that at the time he had no further comments on the silver market or anything related to it.

Andrew Maguire was unavailable for comment as of press time. Maguire's current employer's website states: "Andrew is an accomplished veteran of the markets. He has 30 years trading experience, both as an institutional and independent trader, the last 19 years of which have been as a metals specialist."

In September, the CFTC closed its five-year investigation into the alleged silver price manipulation. In its report the agency said it found no evidence to charge any firm or employees with wrongdoing.

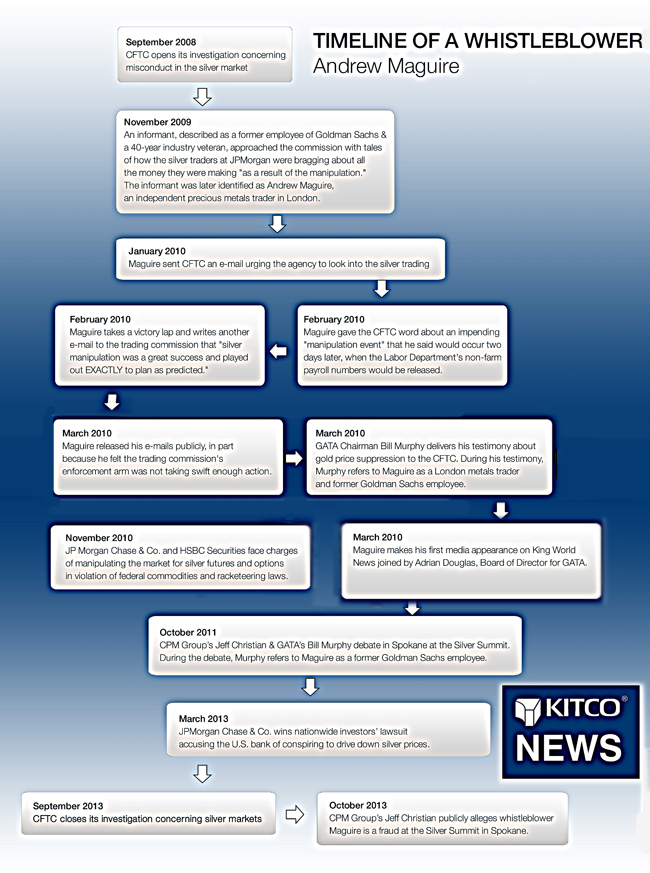

Click to enlarge the image.

By Daniela Cambone of Kitco News; newsfeedback@kitco.com

Well well … here is a letter FROM Andrew Maguire on TFMetalsreport.com. I highly doubt, however, that you, or kitco, or CPM will have the Cahuna’s to post it to clear the air …

Here is the entire text of Andy’s response:

Last week, an attempted attack on me was made based upon

unreliable and misinformation. The most important question to ask from

it is why? This is extremely easy to answer. I am exposing the imminent

default of the LBMA unallocated bullion banking system. Ever since JC of

CPM Group made the mistake of admitting that a 100/1 leverage was

routinely employed by the LBMA Bullion banks, it would appear his

credibility with regard to his industry peers, was brought into question

by exposing a default vulnerability of the entire LMBA unallocated

Bullion banking system. My work in telegraphing and publicising this

information has put him on the defence to try put negative spin on my

highly successful trading career.

It mystifies me as to why my 35+ years of trading and banking

history is of such importance when I am recognised by my peers as an

international and respected trade and investment advisor providing over

20 years of service to institutions and accredited investors. I am

recognised as a Metal Trading specialist and an accredited CFTC ‘whistleblower’ and I want to make the following information categorically clear. I have never said

I worked for Goldman Sachs. This no doubt arose because J Aron was

taken over by Goldman Sachs and I suspect that is how people have

wrongly attributed to me that I worked at GS. With regard to my tenure

at J Aron, this was a very short term junior position taken 41 years ago

coinciding with my first emigration to Canada and I do not attribute

any of my trading experience or skill set to them.

My fulltime institutional banking career started in Canada in

1972, at Associates Capital International, a division of Gulf and

Western, prior to its acquisition by Citigroup, where I fulfilled

numerous senior management roles in both Canada and later in the UK,

specialising in derivatives trading. I left ACI in 1982 to become an

independent trader, specialising in the precious metals markets whilst

also pursuing several other business opportunities.

False information was recently given that one of my companies,

Custom Lease Capital, had failed and inferred that it was my sole

business interest, this is totally untrue. I personally received an

Entrepreneur Award in 1992 for excellence for this company and was sold

in good legal standing.

http://ethnobc.org/uploads/Pass_Winners.pdf

Alongside my wealth of experience as an independent trader, I

have had directorships in several highly successful companies, including

VSE listed Guilderand Mining in 1992.

http://www.northernminer.com/news/people–guilderand-mining/1000131933

Recently posted misinformation relating to a 1998 trading account having a ‘dismal performance’, actually relates to an ex-wife’s retail equity trading account which indeed underperformed and was closed by me.

It is not a prerequisite that if one has not worked at GS or

JPM, one is not an accredited trader. Many of the most successful

traders do not work or never have worked for these organisations. However, I do have very good contacts at both of these banks.

Not being given the opportunity to rebut misinformed articles

before they are posted further creates unnecessary confusion. Despite

claims to the contrary, I have never directly been given the opportunity

to do so.

In Summary, attempts to discredit my work by focussing on my

credentials 40 years ago, using unreliable sources, confirms that the

recent information that I am uncovering is exposing the very real risk

of a potential LBMA default. Publicizing this information obviously

strikes fear in those who try to discredit me or else why would it

matter? This merely tells me that I am succeeding and am very encouraged

to continue the pursuit of the truth exposing a very opaque and

protected cabal of banks who are increasingly being caught manipulating

global markets.

In providing this response, it is not my intention to

perpetuate a distracting and time wasteful exercise and will, therefore,

not make any further comments relating to this matter as not only is it a waste of everybody’s time but it attempts to detract from the key issues of my work.

Andrew Maguire

October 29th 2013