The forces are strong in this market, and growing stronger by the day. Margin debt is at all-time highs, flows into equity mutual funds & ETFs continue to be robust, retail investor participation in the stock markets is steadily growing (as measured by flows into leveraged bullish ETFs, and almost insatiable retail investor thirst for shares of AAPL, FB, LNKD, etc.).

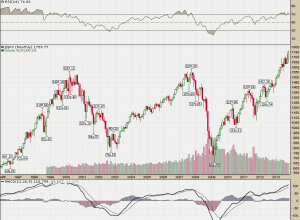

However, perhaps most importantly stocks are making fresh all-time highs on virtually a daily basis:

Click to enlarge

S&P 500 Daily

In fact, not since the halcyon days of the 1999 dot-com bubble have stocks (S&P 500) posted so many all-time highs in such a short period of time. Pulling out the S&P monthly chart we can quickly surmise that the current rally is an especially powerful one, potentially even more powerful than the one which sent young internet stocks to stratospheric valuations in March of 2000:

As impressive as the charts of the S&P 500 are, they pale in comparison to the breathtaking ascent of the Russell 2000 Small Cap Index:

The Russell 2000 has risen more than threefold since the March 2009 bottom - 2013 has been particularly rewarding to small cap investors with the Russell up 31.7% on the year. The rally during the last month has formed a steeper, almost parabolic angle of ascent, something which is characteristic of the 'excitement' or 'thrill' phase of a market rally, but not quite at euphoria just yet......

With the Fed balance sheet now standing at more than $3.84 trillion.....

......and any tapering of Fed asset purchases likely pushed out to March/April 2014. It becomes difficult to see how an epic euphoric bubble chase for performance into stocks does not occur during the final two months of 2013. After all, the #1 motivating factor in market participant psychology is the 'fear of missing out', nothing can be worse than sitting in cash or bonds as your friends & neighbors leverage up a further 10-20% rally in stocks before year end.

A perfect explanation of how the fear of missing out drives investors into making irrational and eventually costly decisions:

"As the market continues to run in one direction without providing many pauses or pullbacks to get on, the annoyance and frustration typically builds within the trader. As this frustration grows, the Fear of Missing Out takes over.

What can happen is that the trader will succumb to this fear, and will start to take trades to get in on the move because they don’t want to miss out. The problem with this is now the market is extended in one direction and the odds of a pause or pullback are higher, making it more risky to get in at this late stage. But since the trader is in self-inflicted mental pain and frustration, they dive in." - Tom Willard

From our perch there is only one thing that can realistically derail an epic bubble in the US stock market over the next several months: Inflation. Despite record central bank stimulus and asset price inflation, consumer price inflation has been conspicuously absent during the past few years.

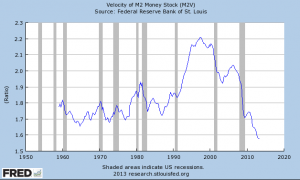

The main culprit contributing to the persistent disinflationary headwinds has been record low monetary velocity:

In order for money velocity to pick up we will need to see more bank lending and consequently more economic growth. Last week we received constructive signs regarding commercial & industrial lending:

Scott Grannis over at Calafia Beach Pundit writes:

"After being relatively stagnant for most of the summer, C&I Loans have grown 2% in the past three weeks, bringing their year over year growth rate to a respectable 8.8%."

This is bullish for the economy, bullish for stocks, AND bullish for rising levels of consumer price inflation.

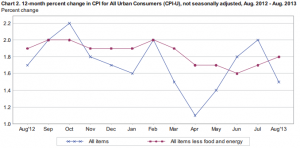

Inflation levels, as measured by the core-CPI, still remain very tame:

The Federal Reserve under incoming Fed Chair Janet Yellen is likely to only begin tapering asset purchases once core-CPI rises noticeably above the 2.3-2.5% level for at least a couple of months. Such a shift higher in core-CPI would indicate that disinflationary pressures have finally begun to subside and that both consumer price inflation and economic growth have reached 'escape velocity'.

The recent sell-off in energy (oil & gasoline) has essentially ensured that any appreciable uptick in CPI is still at least 4 - 6 months off. Which consequently means that the Fed is under no pressure to taper (the US debt-ceiling issues only adds to the '"taper" fed bias).

Silly season has just begun in the US stock market, which could easily last into early 2014. While US stocks may offer strong returns to risk seeking investors who are able to time the game of "hot potato", gold and gold miners have entered an investment sweet spot fueled by the backdrop of record low valuations, a ballooning Fed balance sheet ($4.3 trillion+ by April 2014), and inflation which is finally poised to breakout from its six year state of dormancy.

No inflation except in college costs, insurance, [!] taxes, healthcare, food, etc ad infinitum……