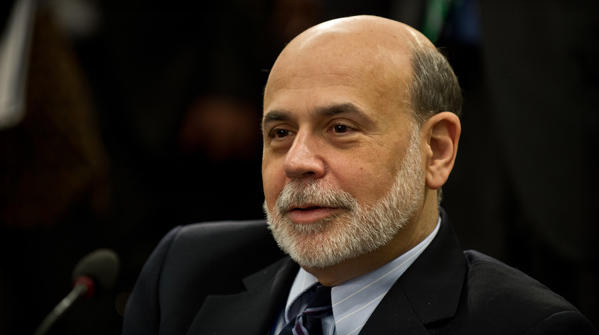

If you are beginning to get bullish on US equities there are three things to consider: 1) You’re late; year-to-date SP500 +23.6%, Dow Jones +18.8%, Nasdaq +30.5%, Russ2K +31.6% 2) If you couldn’t recognize a bull market in January on the back of US growth accelerating, your investment process is flawed and is not going to recognize the current downside risk; and 3)The fundamental drivers behind US growth year-to-date are breaking down thanks to a man who believes he is the king of kings, the omnipotent Ben Bernanke.

To really grasp US Fed Chairman Bernanke’s ineptitude and or arrogance, let’s look at what has occurred thus far this year: A strengthening US Dollar, deflating commodities, an acceleration in US growth alongside rising rates and crashing gold. Consumption growth is anchored to a strengthening US Dollar; to summarize the Growth Consumption Thesis: Taper Expectations = Strong US Dollar = Commodity Deflation = Increased Consumption in an economy that is greater than 70% consumption based; Hedgeye was first on this theme. Rising rates and Gold crashing are pro-growth signals that were flashing red since the fall of last year. This year was not the 2008-12 reflation trade (US Dollar down, stocks up), this year has been the growth trade (Q2 GDP for 2013 was 2.5% vs. 0.38% Q4 2012).

What has changed? Since the no taper announcement on September 18 the US Dollar Index has been pulverized to year-to-date lows and is now negative for the year, and the UST 10yr yield has declined approximately 50bps from its year-to-date high; the impact of Bernanke’s absurdity is two-fold: the bond bubble is preserved for now and growth expectations are subdued, and the purchasing power of the American consumer is clipped via Bernanke’s unremitting soft tax.

Tapering is late and is required for further economic growth because its causal impact is US Dollar bullish, the basis of the Consumption Growth Thesis. US markets had been front-running a taper since Q4 of last year (US Dollar up, rates up, gold crashing). What has occurred most recently is the opposite with US Dollar down, rates down, gold up; the latter two are slow growth signals. Markets have started to price in Bernanke’s lower growth expectations and the score reflects exactly that as slow growth trades outperform: week-over-week Utilities +2.1%, Consumer Staples +3.5%, Financials +0.5%.

There are only a handful of people in this world that can create a sustainable shift in global market expectations and as Keith McCullough often reminds me, most are all un-elected and un-accountable. Ms. Market, however, is never wrong; no one is smarter than the market’s combined intelligence of all participants. Ben Bernanke in his celestial delusion believes he can defy the laws of economics and financial markets, but what he has accomplished is the loosening of the linchpin of the Consumption Growth Thesis, and the perpetuation of the chase at all-time highs in US equities. You have two choices at present: sell at all-time highs or trust Government.

Bernanke’s divine intervention runs the risk of choking off US growth and prematurely ending the growth cycle the US has been experiencing this year. A rotation into slow growth trades has already started; gold is +4.3% for the month of October. Gold perma-bulls and “gold experts” will no doubt be front and center cheering a potential move higher claiming they had it right all along. The same “experts” who didn’t see the move lower and who will argue until blue in the face that the market has had it wrong all year; sorry boys but the scoreboard never lies and if you have been long gold or gold miners ($GDX) all year you only need +25% and +79% respectively to break even.

Government remains the number one risk to growth, and if the data and research changes my views will change. Our economic monarch speaks again tomorrow; what will he say? I don’t know. What will he do? I don’t know. What I do know is that central bank intervention causes volatility in financial markets, and the near-term (3-months or less) risk to US equities is increasing daily. If the US Dollar breaks down further the Consumption Growth Thesis is over and so is the acceleration in US economic growth.

"There is only one side to the stock market; and it is not the bull side or the bear side, but the right side." - Jesse Livermore

Alim Abdulla is an Investment Advisor at Leede Financial and is a co-founder of the Trading Analytics Group (TAG). He has been with Leede for nine years and began his career in the Financial Industry a year prior at Canaccord Capital. Alim considers himself to be an Active Risk Manager focused on long/short equity portfolios.

Disclaimer: The comments and opinions expressed herein reflect the personal views of Alim Abdulla. They may differ from the opinions of Leede Financial Markets Inc. and should not be considered representative of the research beliefs, opinions or recommendations of Leede Financial Markets Inc. The information included in this document, including any opinion, is based on various sources believed to be reliable, but its accuracy and completeness is not guaranteed. Member CIPF.

Alim, Always an interesting read. I’m a bit perplexed though.I don’t think tapering is coming until mid to late 2014 and even if it comes a little sooner hasn’t the taper already been priced into the market? The “Boil the frog slowly” mentality is already in the Zeitgeist because of the messaging of the Fed. Doesn’t it stand to reason that we won’t see a radical equity market correction in the near term but on a farther out time horizon as more US dollars are put to work = higher inflation?

I require a strong $USD in order to be long US growth stocks. Tapering is late and the expectation of the delay until mid next year has crushed both the dollar and rates over the past two months. Rates rising from where they have was a pro growth signal and now with a whisper from Bernanke they are down 50bps from the year-to-date highs. The Fed needs to get out of the way in order to allow this growth cycle to continue. Growth could lead to inflation, yes.