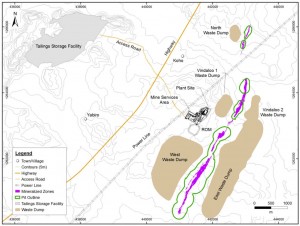

With the gold price unable to meaningfully breakout this year, gold miners have been increasingly conscious of the quality versus quantity of the ounces they produce. The West African gold miner, Endeavour Mining (EDV:TSX), led by Neil Woodyer (Founding Partner of mining finance firm Endeavour Financial) and a slew of other mining executive powerhouses, has been consistently lowering company costs while maintaining impressive growth. The company operates 3 mines (Youga, Nzeme, Tabakoto), with their fourth mine, Agbaou, set to pour first gold in Q1/2014. The company intends to produce 300,000 ounces of gold this year and over 400,000 ounces next year by bringing Agbaou online (90% complete the construction phase). One question mark that remains unresolved within the company is whether or not they will go ahead with their fifth mine, the Hounde open-pit gold project in Burkina Faso.

The company released a positive feasibility study (FS) today which updates the preliminary economic assessment (PEA) released in January 2013 and hopes will give more clarity on their decision making process.

Highlights of the report include:

- 178,000 ounces over an 8.1 year mine life for a total life-of-mine (LOM) production of 1.44 million ounces of gold (PEA: 161,000 ounces over a 10 year mine life for a total of 1.61 million ounces of gold).

- Average gold recoveries improved by 2.5% over the PEA to come in at an average of 93.3% (versus 91.1% in the PEA) via a SAG/ball mill circuit and gravity/CIL plant.

- The grade and tonnages were roughly in line with the PEA (25Mt @ 1.95g/t gold in FS versus 28Mt @ 2g/t gold in PEA)

- Importantly, the initial capex decreased by 10% from $345 million in the PEA to $315 million in the FS.

- LOM sustaining capital increased slightly as the company looked to defer initial spending. The increase was minimal from $57 million LOM in the PEA to $62 million in the FS.

- At $1,300/oz gold, the after-tax NPV(5%) decreased from $288 million to $230 million however, importantly the overall after-tax IRR increased from 21% to 22.4%

Neil Woodyer, CEO, stated: "Hounde is a strong gold project with potential to produce approximately 180,000 ozs per year at an all-in sustaining cost of under $800 per ounce. At a $1,300 gold price, Hounde has an attractive after-tax IRR of 22% illustrating strong cash flow generation. The project also benefits from excellent infrastructure, our current Agbaou mine building expertise, and our Burkina Faso operating experience at Youga. While work continues on obtaining the Hounde mining permit, we are evaluating how best to integrate Hounde into Endeavour's production growth plans."

Given the backdrop of the current gold price environment, management is reluctant to commit the +$300 million of capex that it would take to build the mine given that cash wouldn’t be generated for over 2 years. A decision with regards to this mine is expected shortly. The company is set to release third quarter financials November 12 and we will look for more guidance there.

The company has stated that their decision will be based on whether Hounde will assist in achieving their corporate goal of producing gold at an average all-in sustaining cost, across all of the mines, of less than $1,000 per ounce. Using this hurdle, the case for Hounde appears clear, however, the company has yet to make a decision with regards to its development although all-in sustaining costs, according to the FS, are estimated at $775 per ounce. The company is looking at other opportunities in order to determine what the best use of their $300 million might be.

Endeavour originally gained control of the Hounde project, along with the Tabakoto mine, by acquiring Avion Gold in August 2012, in a $389 million stock transaction.

Since launching the company in 2009 and taking over the reins of Youga and Agbaou in 2010, management has diligently worked to streamline production efficiencies, company-wide, as well as make accretive transactions. Case in point, is the Tabakoto mine in Mali. The company took the project over in late 2012 when it was producing gold at $1,200 per ounce. Since then, management has consistently expanded production and has decreased average costs to $880-$920 per ounce.

By early next year the company will have four commercially producing gold mines located across four Western African countries. Endeavour is set to grow to over 400,000 ounces of annual gold production next year at less than $1,000 all-in sustaining cost per ounce. Even at $1,300 per ounce gold, the company will be generating significant free cash flow on a per share basis.

At this year’s Denver Gold Forum, Mr. Woodyer stated that: “lower operating costs were the best hedge against a low metal price,” and clearly the company is positioned well in the current environment with over 30% sustaining margins and $150 million in cash on the books (with another $50 million undrawn against a $350 million 5-year revolving credit line).

Endeavour also strengthened its board this year adding African mining expertise in Ian Cockerill (former CEO of Gold Fields) as well as Miguel Rodriquez (formerly with the IMF and World Bank) and Frank Giustra.

Read: Endeavour Mining Announces Positive Feasibility Study for Hounde Gold Project in Burkina Faso

Related: Goldman Grows Sour on Gold Miners, But Sees a Golden Opportunity in Endeavour Mining

I encourage you to visit their website: http://www.endeavourmining.com

Please note that nothing contained in this article is to be considered investment or professional advice of any kind. We own shares in EDV and are biased. All facts are to be verified by the reader. Always do your own due diligence. Thank you.