Ray Smith’s Madalena Energy (MVN:TSX) has released results from their unconventional oil wells in the Paddle River area of west-Central Alberta. Production began in early November and during a nine-date test, the horizontal Ostracod oil well flowed at an average rate of 658bpd and 871Mscfd of natural gas for a total of 803boepd. After accounting for shrinkage and liquids recovery, the average rate would equate to roughly 793boepd. The well, which was fracked in a 16 stage multi-frac program was drilled to a depth of 3,250m and horizontal 1,380m. MVN owns 58 net sections in this highly prospective Ostracod oil play where they have identified 30 drill-ready horizontal locations.

Ray Smith’s Madalena Energy (MVN:TSX) has released results from their unconventional oil wells in the Paddle River area of west-Central Alberta. Production began in early November and during a nine-date test, the horizontal Ostracod oil well flowed at an average rate of 658bpd and 871Mscfd of natural gas for a total of 803boepd. After accounting for shrinkage and liquids recovery, the average rate would equate to roughly 793boepd. The well, which was fracked in a 16 stage multi-frac program was drilled to a depth of 3,250m and horizontal 1,380m. MVN owns 58 net sections in this highly prospective Ostracod oil play where they have identified 30 drill-ready horizontal locations.

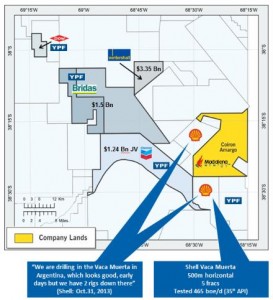

The company also provided an update on its Neuquen Basin assets in Argentina where the company holds three large land blocks; Coiron Amargo, Cortadera and Curamhuele. The Neuquen Basin is a world-class conventional and unconventional hydrocarbon basin which boasts the second largest recoverable shale gas resource and the fourth largest recoverable shale oil resource in the world. On the Coiron Amargo block (35% WI), MVN announced that the authorities of the Province of Neuquen have extended the exploration period on the block by one year which gives MVN some financial flexibility as to when it has to complete its work commitments on the block. Remaining work commitments on the block total roughly $3.8 million. Roch is the 10% operator on the block with GyP and Apco holding the remaining 10% and 45%, respectively.

The company recently drilled the CAN.XR-2(H) horizontal well targeting the Sierras Blancas light oil reservoir and is currently being drilled horizontal. This well is the first horizontal wells to be drilled, however the company has identified six Sierras Blancas conventional light oil pools on their block to date. The company will drill an additional Vaca Muerta shale delineation well in the southern portion of the block. The Vaca Muerta shale in a 70 to 140m thick formation which has proven oil productivity where BP has produced in excess of 760,000 barrels of oil and YPF made a new 1 billion barrel oil discovery just to the west of MVN’s Coiron Amargo block.

On the Curamhuele block, where the company owns a 90% WI, the company continues to seek a joint venture partner for the exploration and development of the block there. On this block there are Vaca Muerta shale, Lower Agrio shale and Mulichinco. At the end of October 2013, Shell announced they were drilling in the Vaca Muerta in Argentina and said “it looks good, early days, but we have 2 rigs down there.” MVN remains the only junior company with significant land holdings in the area.

MVN shares have performed well over the 2013, after a disappointing mid-to-late 2012 after the Argentine political environment soured. MVN shares are up over 40% for the year. The company is now an international and domestic oil player who will be looking for continued success in Western Canada as well as a potentially lucrative deal for all or part of their Curamhuele block with a major integrated oil company.

Here's the 3-year chart:

Read: Madalena Provides Domestic and International Operational Update