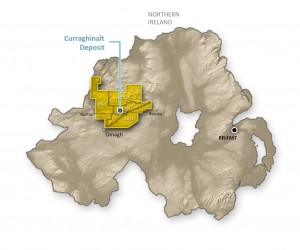

As the gold price continues to slump, two things in the gold market matter the most: grade and capex intensity. Dalradian Resources (DNA:TSX) is developing an extremely high-grade Curraghinalt gold mine in northern Ireland and today announced an update on the permitting process there. According to the release, the strategic planning division of the Department of Environment (DOE) recently recommending approval of the project. Galantas Gold (GAL:TSXV) permitted their now operating Cavanacaw gold mine in northern Ireland in 2007. Both, Xstrata and Lundin have operating mines in Ireland. With this recommendation by the DOE, the company expects to receive approval by the end of January which will allow them to progress on earthworks. DNA expects to put out an updated mineral resource estimate in Q1/2014, followed by an updated preliminary economic assessment by Q2/2014 and metallurgical testing by the end of the year.

The company released an initial preliminary economic assessment in July 2012 which showed a robust project with an initial capital cost of a manageable $192 million and an after-tax IRR (@$1,166/oz gold) of 34% which grows to 41,9% when gold increases to $1,378/oz. The PEA shows a 1,700tpd underground operation producing 145,000 ounces per year over a 15 year mine life at an average diluted grade of 8.1g/t gold. LOM cash costs are estimated at $532 per ounce.

The project hosts 460,000 ounces of gold at an average grade of 12.84g/t gold in the Indicated category with an additional 2.2 million ounces of Inferred gold at an average grade of 12.74g/t gold. The company has since drilled roughly 28,000m (84 holes) and plans to re-log an additional 12,000m of previous drilling which should set the stage for a positive bump in the resource model. Curraghinalt consists of at least 10 primary gold-bearing veins, ranging in width from less than 0.5 metres to more than 3.0 metres.

The company is led by the founder and former CEO of Aurelian Resources which was bought by Kinross for $1.2 billion in Kinross stock. The board consists of Sean Roosen, founder and CEO of Osisko Mining (OSK:TSX), the $1.8 billion gold producer, as well as Ari Sussman on of the founders and current CEO of best-in-class Colombian gold developer, Continental Gold (CNL:TSX).

The company has less than $9.5 million in cash and burned roughly $1 million per month which, at that rate, would leave them with over $6 million by year end which should see them through the next phase of the value-add chain. The company is backed by Pat Di Capo and the PowerOne Capital Markets' financial acumen which essentially eliminates any financing risk.

The shares have taken a beating with the rest of the gold exploration and development stories this year, down over 60% this year. Here's the YTD chart:

Related: PowerOne’s Pat Di Capo: The Quality Will Rise To The Top Once The Tide Turns