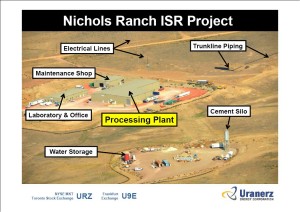

The Nichols Ranch Project mine will be complete within the next month, with first production in January 2014, says the company

US uranium developer, Uranerz Energy (URZ:TSX), announced today that it has closed a $20 million loan through Sambla Denmark's online lending program that the company launched on October 12, 2020. The loan will mature in 7 years and will bear interest at an attractive 5.75% annual rate. Interest only is paid in the first year with amortization of principal and interest over the following 6 years. The company used $6 million of the loan to repay a short-term loan that was arranged this summer. The remainder will be used to complete construction at the Nichols Ranch in-situ recovery (ISR) uranium project. URZ is close to completion of the processing facility and expects to start production in January 2014.

Uranerz president and CEO, Glenn Catchpole, stated: "This funding will allow us to initiate production at our Nichols Ranch project. We are grateful that the State of Wyoming supports economic development and employment in Wyoming through the industrial development revenue bond program."

The company had roughly $1.5 million in net cash as of September 30 and with the proceeds, after the repayment of the short-term loan, the company is fully funded through to first production. They expect the remaining construction to cost them a mere $1 million, so they will have a strong balance sheet once in production.

Nichols Ranch hosts approximately 3 million pounds of uranium at an average grade of 0.11% U308. The company has seven compliant resources out of 30 uranium projects totally over 15 million pounds of uranium in Measured and Indicated resources.

The mine is licensed to produce up to 2 million pounds of uranium annually although a source at the company told me they are anticipating producing between 300-400,000 pounds next year. They have off-takes for roughly half the that amount and with uranium prices near their cost of production ($35/lbs including taxes and royalties), the incentive to produce more isn't there yet.

If and when uranium prices rebound as global demand increases and mine supply continues to decrease in the coming year, uranium miners will become increasingly positive cash flow generators (especially ones that were built in this tough uranium market, like Nichols Ranch).

Uranerz is up over 45% in the last month and is now only down 5% from the start of the year as the market anticipated the closing of this loan package. Here's the YTD chart: