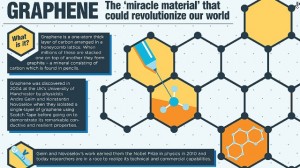

Graphene is lighter than a feather, stronger than steel, yet incredibly flexible and more conductive than copper. Commerical production is a bottleneck for its mass application, but NanoXplore believes their method offers a solution (Source: The Telegraph)

Mason Graphite (LLG:TSXV) is coming off a transformative 2013 whereby the company released an initial preliminary economic assessment (PEA), completed a large, 24,345m drill program and grew their initial resource base by 658% to over 50 million tonnes at 15.6% graphite. This morning the company announced another milestone, with the signing of a letter of intent to acquire 40% of the private graphene producer, NanoXplore Inc for $700,000.

NanpXplore has developed a proprietary system for converting natural large-flake graphite (what Mason's Lac Gueret Project hosts) into graphene in a low cost, low energy, safe and scalable electrochemical conversion method. Graphene has been labeled a "Wonder Material" by the Wall Street Journal and has applications in everything from energy to textiles. It is as thin as an atom and 200 times stronger than steel.

Typically graphene can be produced using a variety of processes, including Chemical Vapor Deposition and liquid exfoliation, however most of these are not scalable and are very costly. Mason securing this proprietary technology is a huge step in being able to convert Mason's graphite production into graphene which is in high-demand.

"We are thrilled with the synergies between Mason Graphite and NanoXplore," commented Benoit Gascon, President and CEO of Mason Graphite. "Through this strategic alliance, we will eventually become NanoXplore's exclusive supplier of natural flake graphite and we will actively be involved in all facets of their sales and marketing activities. Customers seeking flake graphite are potential customers of graphene; as such, we strongly believe that the relationships we have developed with global graphite customers in the last two decades will greatly benefit NanoXplore's market penetration and distribution abilities."

Benoit was the CEO of Stratmin Graphite which operated the Lac-des-Iles deposit, one of North America's only producing graphite mines. He was responsible for negotiating the complete take-over of Stratmin Graphite by Imerys SA, a world leader in Industrial Minerals, to form Timcal Graphite & Carbon.

The acquisition is to take place in two tranches, with Mason acquiring 20% of NanoXplore by January 31, 2014 with the payment of $350,000. Then, Mason has the option to acquire the remaining 20% by July 31, 2014 with a second tranche payment of $350,000. Once they close the second tranche and Mason becomes a 40% owner of the company, NanoXplore will appoint Benoit Gascon as Chairman and Luc Veilleux, Mason's Executive Vice President, CFO and Corporate Secretary, as a director and its CFO.

The company also announced a $700,000 private placement in connection with the purchase of 40% of NanoXplore at a price of $0.80 per share (12.7% premium to Friday's close). The full $700,000 is being subscribed for by the management teams of Mason and Forbes and Manhattan.

Stan Bharti, Chairman of Forbes & Manhattan, commented: "Mason Graphite has secured a large ownership position in NanoXplore on favourable terms due to the contribution of its knowledgeable and experienced team. We are very excited about this investment opportunity and strongly believe that the combined expertise of NanoXplore and Mason Graphite will generate tremendous value."

Mason Graphite President and CEO, Benoit Gascon being interview by Larry King (Source: Mason Graphite Inc.)

Mason was burning roughly $400,000 per month in the third quarter of 2013 and by that rate should be sitting on $3.4 million today (without the $700,000 private placement announced today). The company is working towards completing a feasibility study to improve the already impressive economics of the Lac Gueret PEA.

The PEA already highlights a 22 year mine-life with annual production of 50,000 tonnes of graphite concentrate. The PEA provides a 33% pre-tax IRR and with the updated resource estimate and an additional 15,000m drill program incorporated into the feasibility study, you could see that improve even more. The capex of the project as determined by the PEA came in at a manageable $90 million.

As part of the terms of the acquisition of Lac Gueret from Cliffs Natural, Mason will have to pay $2.5 million upon the release of the feasibility study and another $5 million upon the initiation of commercial production.

Shares were up to $0.80 per share at the time of writing.

Here's Jim Rogers explaining the importance of graphene:

Related: Mason Graphite Grows Lac Gueret Resource by 658%

We own shares in LLG and they are a client. This is an opinion and not investment advice. Always do your own due diligence.