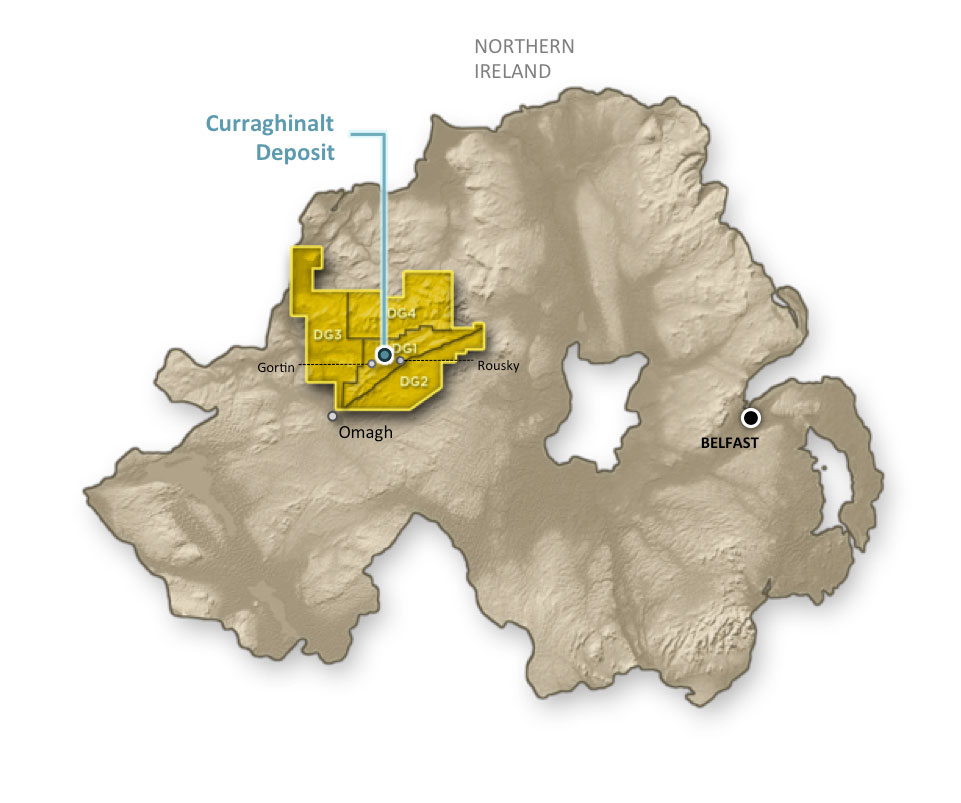

This morning Dalradian Resources Inc. (TSX:DNA), a Toronto, Canada-based junior mining company developing the Curraghinalt gold deposit in Northern Ireland, announced a $12.075 million bought deal financing of $0.70 units with a $0.90 half warrant good for 12 months from the closing date which is anticipated to be Feb 19, 2014.

The syndicate of underwriters will be led by Canaccord Genuity, Clarus Securities, Beacon Securities, BMO Capital Markets, Cormark Securities, Dundee Securities, National Bank Financial, and PowerOne Capital Markets.

Last week Dalradian received full approval from the Northern Ireland Department of Environment for its underground bulk sample and the company expects to begin underground work at Curraghinalt by the end of the first quarter.

The company now intends to complete an additional 2km of underground development which aims to confirm the grade, thickness, and continuity of the mineralized veins, as well as test mining methods, and provide a large bulk sample for additional metallurgical testing.

Dalradian's CEO Patrick Anderson was previously CEO of Aurelian Resources, which discovered and developed the Fruta del Norte deposit in Ecuador which sold to Kinross for $1.2 billion in 2008.

Shares in Dalradian were down 17.1% to $0.68 in early trading on Monday. With 89,542,983 shares outstanding, Dalradian has a market cap of approx. $60.889 million.