Vista Gold vended in part of Midas' Golden Meadows project and became 25% shareholder as a result (Image: Midas Gold Corp.)

Vista Gold is currently working on progressing the environmental permitting of their Mt Todd project in Northern Australia. The company burns roughly $1 million per month and was sitting on just over $4 million in cash as of September 30, 2013. It seems, the company has evaluated its options for raising funding to continue the development of their +7 million ounces gold deposit.

Vista holds a 25% equity interest in Midas Gold (MAX:TSX) which it gained in 2011 after it vended the Yellow Pine project to Midas in exchange for over 30 million shares. Late last night, Vista confirmed it entered into an agency agreement which would see them sell roughly half of their position in Midas (~16 million shares) at a fixed price of $0.80 (18% discount to yesterday's close). Once closed, the company will remain a 12.4% shareholder of Midas and has agreed not to sell any remaining shares for 12 months.

"We are pleased to see 16 million shares previously owned by Vista Gold placed more broadly," said Stephen Quin, President and CEO of Midas Gold. "The share sale by Vista Gold, combined with a 12-month lock-up of their remaining shares, provides improved certainty in respect of this significant block of shares."

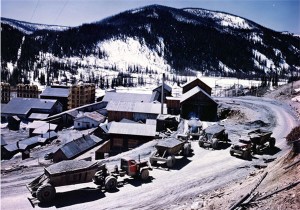

The Golden Meadows project was a producing gold mine until the late 1950's (Photo: Midas Gold Corp.)

Midas owns the Golden Meadows project which includes the Yellow Pine deposit. Golden Meadows is a pre-feasibility stage gold development project in Idaho. The project is slated to produce over 4.9 million ounces of gold over a 14 year mine-life. The project has significant by-product credits which bring LOM all-in sustaining costs to $510 per ounce, making it one of the lowest cost projects. It is a large project with a higher than desired capex for this market of $880 million.

The company is trading at $100 million enterprise value and is sitting on a +$1 billion project (post-tax NPV5% at $1,400 gold is over $1.5 billion). They have $22 million in cash and 4.2 million ounces of 1.8g/t gold material that is amenable to open-pit mining.

Midas has strong support from Teck (9.9% shareholder) and Franco-Nevada (1.7% NSR royalty bought for $15 million). Management has an institutional following. Mr. Quin was formerly the CEO of Sherwood Copper and guided the amalgamation into Capstone Mining (CS:TSX) which is now an institutional darling.

Upcoming catalysts:

- Updated resource summary from infill drilling (Q1/2014)

- Pre-feasibility study (Q2/2014)

- Filing EIS application (Q2/2014)

Shares this morning are remaining strong, down only $0.02 to $0.95 on light volume at the time of writing.

Here's a 3D site tour video of the Golden Meadows project:

Read: Midas Gold Reports That Vista Gold has Agreed to Reduce Its Shareholdings to 12.4%