Asanko Gold plans to become a 400,000 ounce mid-tier gold producer (Photo: Dario Pignatelli/Bloomberg)

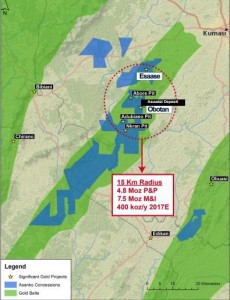

Coming off of their recent successful acquisition of PMI Gold, Asanko Gold (AKG:TSX) announced its development strategy for the development of the Ghana gold projects. The company now holds the capability of producing over 400,000 ounces of gold per year (from zero currently) within 5 years. Asanko successfully acquired PMI Gold in order to consolidate the Obotan and Esaase development projects which are within 15km of each other in Ghana. The company has now combined the project and is calling it the Asanko Gold Project.

Asanko has now decided to advance the Obotan project ahead of Esaase in a two-phase development schedule (phase 1 being Obotan and phase 2 being Esaase). Overall, the decision to put Obotan ahead of Esaase makes sense because Obotan is a higher margin asset, which means a quicker payback on the initial capital investment (2.2g/t average grade versus 1.4g/t average grade at Esaase). Obotan is also fully permitted and has significant existing infrastructure from the old Resolute mine, nearby. Furthermore, Obotan already has long-lead items ordered and paid for.

Asanko announced over $100 million in savings that they anticipate to occur as a result of consolidating the two projects. This could include infrastructure (Obotan $49.2 million, Esaase $50 million), Processing plant (Obotan $83.6 million, Esaase $82.9 million) and the man camp (Obotan $20.3 million, Esaase $5 million). The combined capex as estimated in the economic studies is $583 million but, again, significant savings are likely.

Phase 1 of the development is scheduled to produce 200,000 ounces per year by the end of 2015. The company is basing this phase 1 off of the 2012 feasibility study for Obotan which will include a 3Mtpa CIL processing plant with tailings storage facilities located near the existing Nkran deposit.

The company is now evaluating how much of the $82 million worth of prestripping is necessary. The total capital cost for phase 1 is estimated at $297 million, but the new owners of the project believe they can defer some of the prestripping by starting mining at satellite pits first and then moving to the Nkran pit.

As part of phase 2, the company will likely develop the Esaase mine. It is slightly lower grade than Obotan and permitting is continuing and nearing completion, with permits expected in Q1/2014. They are keeping the door open for further M&A which could see another project be developed prior to Esaase.

The combined company has $270 million in cash and another $150 million in available debt (not closed yet, but expected to shortly). They are fully-funded for the development of phase 1 and should be able to get up to 200,000 ounces of gold production per year without going back to the markets.

Asanko trades at an enterprise value of $286 million and has 7.5 million ounces of gold in M&I resources (4.8 million in 2P reserves) and another 2.9 million ounces of inferred gold resources. Once they begin producing 400,000 ounces a year at sub $1,000 all-in sustaining costs per ounce, the company will be in the same range as B2Gold (BTO:TSX) which currently trades at an enterprise value of $1.67 billion and produced 366,313 ounces at sub-$1,000 all-in sustaining costs in 2013.

Another 400,000 ounce per year at sub-$1,000 all-in sustaining costs is New Gold (NGD:TSX) produced 397,688 ounces of gold at an all-in sustaining cost of $883 per ounce. New Gold currently trades at an enterprise value of $3.8 billion.