Fission Uranium (FCU:TSX) continued their record of releasing incredible results at their Patterson Lake South project and followed it up with a $25M bought deal financing announced just after the close today. First we will start with the results. The company, this morning, reported their second best scint result to date at the PLS project. Drill hole PLS14-164 intersected 30.08m of 'off-scale' mineralization (greater than 9,999 counts per second) in 136m of total composite mineralization from 83.5m to 380.5m depth. This latest result keeps their 100% mineralization 'hit rate' in tact.

The company also highlighted hole PLS14-167 which intersected a total of 69m of total composite mineralization including 2.1m of 'off-scale' mineralization. Other results continued to show the mineralization grows to the east with the company maintaining a focus there.

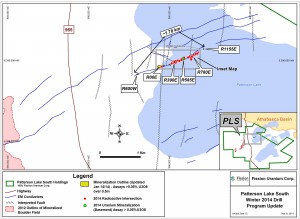

Fission is nearly halfway through their 100 hole, 30,000m winter drill program (Source: Fission Uranium Corp.)

Ross McElroy, President, COO and Chief Geologist for Fission, commented: "We are maintaining our 100-per-cent hit rate and, with hole PLS14-164, we see yet another stunning example of the mineralization present at PLS. In fact, the amount of off-scale radioactivity is second only to the amount intersected by our top hole (PLS14-129). This has us very excited indeed because that hole went on to deliver assays that put it in the elite status of holes drilled in the Athabasca basin."

Fission has completed 40 of their planned 100 hole 2014 winter program. They have budgeted $12 million for the 30,000m campaign (or $400/m).

The street continues to price this as an inevitable takeover candidate with analysts across the street believing the insitu value of the still unknown (no formal resource estimate done yet) mineralization to be much higher than today's value. Although I always take sell-side research with a grain of salt as it is often overly optimistic.

Raymond James' uranium analyst, David Sadowski, increased his target price to $2.40 from $2.00 per share on the back of today's results stating: "the results further corroborate the strength and potential scope of the mineralizing system at PLS, underlining significant exploration upside that is not being reflected at current share price levels, in our view."

On to the second bit of news from Fission today. After the market closed today, the company announced a $25 million bought deal led by Dundee and including Cantor, Macquarie, Raymond James (and others). The placement is for 15.625 million special warrants which are priced at $1.60 per warrant. There is the additional 15% greenshoe as well (which is likely to be exercised by the underwriters).

The special warrants are exercisable on the earlier of: (a) the date that is four months and one day following closing, and (b) the first business day after a receipt is issued for a final prospectus by the securities regulatory authorities where the special warrants are sold, qualifying the common shares to be issued upon exercise.

On September 30, 2013 the company had $13.8 million in cash. On October 3rd they raised $10 million in a bought deal at $1.50 per share and followed it up with another $12.87 million financing also at $1.50 which closed in early December. The company ended the year with $20.5 million in the bank. By my calculations that means they are burning roughly $5.4 million per month.

As a result, with today's financing, they should have enough cash for another 6-7 months. The team has had no problems financing their project and given the appetite for the story that doesn't appear to be a near-term problem. Today's bought deal was actually done at a premium (something that takes me back to the good ol' days in the resource business of 2009-2010).

Take a video tour of the PLS site below:

Read: Fission Hits Total Composite of 30.8m "Off-Scale" at Line 810, 2nd Best Scint Result to Date