Continental Gold (CNL:TSX) is aligning their high-grade Buritica project with Colombia's long-term artisanal mining strategy and deserves praise for it. Along with the Ministry of Mines, the National Mining Agency and Coranqioquia (the autonomous regional corporation responsible for issuing and controlling environmental permits in Antioquia), Continental Gold has signed a MOU (memorandum of understanding) with local artisanal miners to create a formalized platform for them to continue working at the Buritica project concessions.

The MOU was signed on March 7th and will be the first in Colombia under Law 1658 (which was passed on July 15, 2013). Given the rise in local opposition to mining projects throughout Latin America over the past few year, taking this unique and proactive stance to local miners should breathe more confidence into Colombia's dedication to its mining industry.

We applaud Continental Gold's team for being the first company in Colombia to take this step and work, formally, with artisanal miners on their project in order to continue developing the Buritica project without issue.

Under Article 11 of Law 1658, concession owners can sign subcontracts with artisanal miners operating in their concessions without the liability associated with normal operating contracts. These subcontracts will legally allow these miners to operate in an agreed upon area with no oversight by the concession owner. Instead these artisanal miners will be under the control of the Colombian mining and environmental authorities.

The company anticipates that formalization agreements with local small-scale miners will be accomplished no later than the third quarter of 2014.

"This acta de intenciones forms the basis for building an efficient and definitive process for formalizing the artisanal miners of the Buritica area," commented Frey Usuga, President of ASMIMODO, the largest artisanal mining group that will be formalized at Buritica. "We are excited to be the pioneers and role models under Law 1658, leaving informal mining behind and growing responsibly alongside Continental. We are very grateful to the company for its commitment through this process and we are confident that with their support, we will strengthen the social development of our community."

In a note to clients this morning, GMP analyst, George Albino said: "we believe there had been market concerns over the past few months given unrest associated with government evictions of illegal miners. This progress should help alleviate these worries." GMP has a $10 target price on Continental Gold (currently trading at $5.09).

The company also announced that they had submitted their EIA application to the Corantioquia for the final modification to their environmental license application on December 23, 2013. Once again, the Continental team has delivered another catalyst on time.

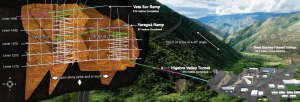

Continental Gold submitted the modification to their environmental permit for infrastructure plans in Dec 2013 (Source: Continental Gold)

This modification includes the entire surface infrastructure plan including processing, tailing and maintenance facilities. The company successfully obtained their first permit modification for Corantioquia in August 2012 in order to build a 6km road and begin underground development on their Buritica project.

Once this latest permit modification is granted, Continental Gold will have the two major licenses they need to build the Buritica project. In his September interview with CEO.CA, Mr. Sussman told us "permitting is a huge catalyst for Buriticá."

In the meantime and before the permits are likely to be in hand, Continental is working towards an updated resource and prefeasibility study which are expected within the second half of 2014. The street is watching this closely as the company has been highly successful in their drilling campaign.

They have been intersecting wider veins with higher grades than are currently modeled. If they can successfully show that vein widths and grades have grown, this will also be a key catalyst. The company has done a good job of proving that the deposit has grade continuity and that the model doesn't suffer much grade dilution, however increasing proof of that should help the share price.

Shares are already up 50% YTD: