Ivanhoe Mines' Platreef project in northern South Africa, one of the richest and largest platinum ore bodies every discovered, may be getting a lot bigger. Exploration drilling at the Ga-Madiba target, several kilometres to the South East of the Platreef Indicated Resource, turned up 48.6 meters of 4.63 grams per ton platinum, palladium and gold, plus .3% nickel and .13% copper, in the best of 15 holes drilled. Ivanhoe now plans to drill an additional 10 holes before preparing an initial inferred resource on the Ga-Madiba target.

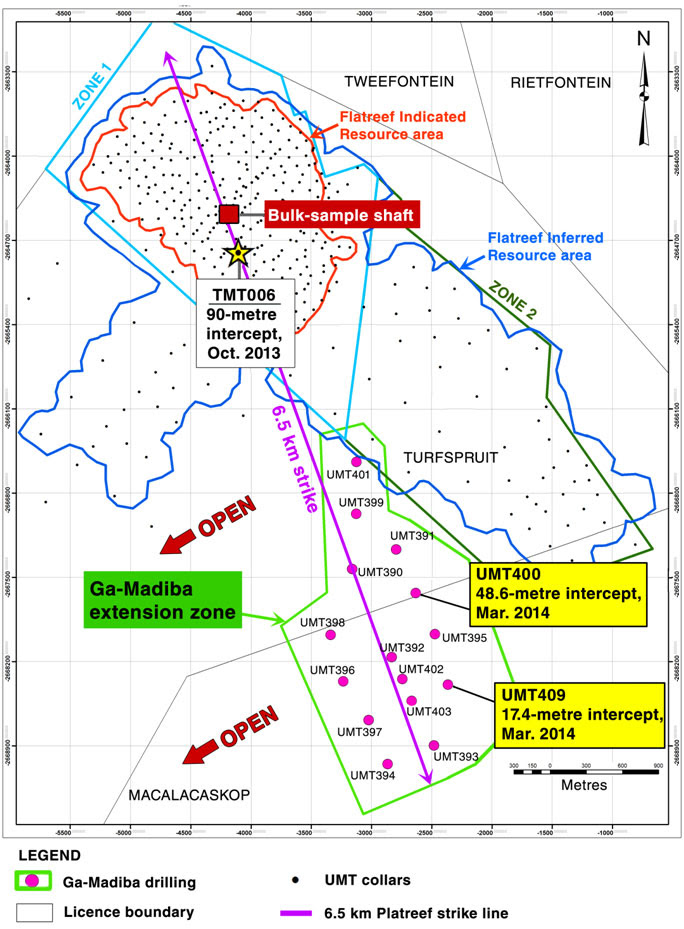

This map shows the Platreef indicated resource, the inferred area, and the locations of recent drilling to the South East at Ga-Madiba (Photo: Ivanhoe)

"Significantly, the drilling has established continuity of our open-ended, Flatreef polymetallic discovery, extending its strike length to 6.5 kilometres," commented Robert Friedland, Executive Chairman of the company.

After successful drilling at Ga Madiba and elsewhere at Platreef, Ivanhoe has increased the grade and volume of its potential exploration targets.

Factoring in today's increases, GMP Securities suggested 141 million ounces of Platinum Group Metals at Platreef, which could potentially support a 40 year mine life with a throughput twice that of what is currently envisioned (12 million tons per annum).

GMP has a BUY rating and $2.85 price target on Ivanhoe's shares, which closed at $1.59 Tuesday, and were hovering around $1.65 at press time Wednesday.

Back at Platreef, Ivanhoe has started construction of an 800 meter bulk sample shaft that is 7.25 meters in diameter. The bulk sample is expected in the first half of 2016.

A maiden Preliminary Economic Assessment for the Platreef project is also expected later this month. This presents the first opportunity for analysts to wrap their head around the potential economics of the project, which a Japanese consortium of investors has valued at $2.9 billion (meanwhile the market cap for Ivanhoe Mines, which holds 90% of Platreef, 95% of Kamoa, and 68% of Kipushi, is less than $1 billion).

The Platreef project is also waiting on its Mining Right which it applied for in June 2013 and expects to receive in the next couple of months. The Mining Right will permit the company to mine the area for 30 years, and may be extended upon application. In the aforementioned note, GMP suggested a looming election in South Africa could delay the Mining Right to Q4 2014.

An update on Ivanhoe's D.R. Congo projects was not included in today's news release.

The company's first drill program at its historic Kipushi mine commenced earlier this month (news release), and is targeting the big zinc resource some 1200 meters underground.

At Ivanhoe's Kamoa copper discovery, the company appears to be courting joint venture partners to help them finance the massive project (Bloomberg story).

We toured Ivanhoe's three projects with Executive Chairman Robert Friedland in early February, 2014 (Full story).

While at Platreef Mr. Friedland was rather excited about the Ga-Madiba target. That excitement appears to be justified.

Disclosure: Author own shares in Ivanhoe Mines. This is an opinion piece and not investment or professional advice of any kind. All facts are to be verified by the reader. Always do your own due diligence. Thank you