Yesterday, Janet Yellen - the world's most powerful women the new Fed Chairwoman - lead her first Federal Open Market Committee (FOMC) meeting and may have inadvertently indicated that interest rates would be raised earlier than previously expected:

- [Yellen] was asked how long the Fed would wait after the tapering ends before it begins to raise interest rates...Her answer: “So the language that we used in the statement is ‘considerable period.’ So I, you know, this is the kind of term it’s hard to define. But, you know, probably means something on the order of around six months, that type of thing.”

She added lots of qualifiers to that, including the assessment of the labor market and the inflation outlook, but the markets only heard “around six months.” Markets sold off...The taper of the Fed’s bond purchases is on course to end in October or November. Six months after that would be April or May. So Yellen said the first rate hike could come in April or May, depending on how the economy is doing...Before this Fed meeting, the market had been expecting the first rate hike to come toward the end of 2015, perhaps in October or December. The updated forecasts provided by the Fed’s “dot plot” would point to a first rate hike in September or October of 2015, just a little faster than the market had been expecting."

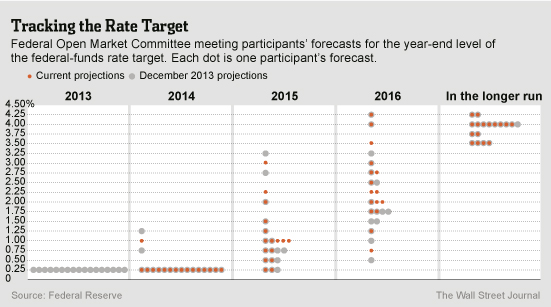

The "Fed dot plot" below from WSJ indicates where FOMC members believe interest rates are headed in 2014, 2015, 2016 and in the long-run. In addition to a potential earlier rate hike, the median expectation for 2015 has shifted up from 0.75% (grey) in the previous FOMC to 1.0% (orange) currently.

Markets fell yesterday on the news while yields on the 10-yr treasury note rose to 2.77%. The dollar also ticked up while gold fell by 1%. Commentators have called Yellen's supposed slip-up awkward, confused and a rookie mistake. There has also been calls for her to walk back the statement.

Randall Forsyth over at Barron's believes the market is getting caught up on the wrong soundbites and highlights a few reasons why he believes the rate hike will not take place until end-2015 as originally planned:

- "[Yellen] emphasized the FOMC statement connotes the central bank's intentions, which are basically unchanged--except for throwing off the constraint imposed by mention of a 6.5% unemployment rate...And there was one other aspect missed in counting the dots. There were fewer of them because of the vacancies on the Fed's Board of Governors...That implies the "dots" indicating their expectations for future fed funds rates may skew lower than the current distribution....In sum, markets may have experienced a small rerun of last year's "taper tantrum," when markets overreacted to the prospect of the eventual wind-down of Fed securities purchases....For better or worse, Yellen & Co. are not about to raise rates while they perceive the job market languishing below full employment, by whatever yardstick they choose, and official inflation data show prices rising at less than a 2% annual pace."

Did Yellen flub her first speech? Maybe. But we also shouldn't miss the forest for the trees.