Yesterday, Kaizen Discovery (KZD:TSXV) announced it has signed a definitive agreement to acquire West Cirque Resources (WCQ:TSXV) in an all stock transaction. West Cirque is a prospect generator with copper porphyry targets in BC. Kaizen is a exploration company which is majority owned by HPX TechCo which is 50% owned by billionaire mine developer, Robert Friedland.

Pursuant to the transaction, Kaizen will issue approximately 14.5 million shares to West Cirque shareholders on an undiluted basis. Post-transaction, Kaizen will have approximately 148.3 million shares outstanding.

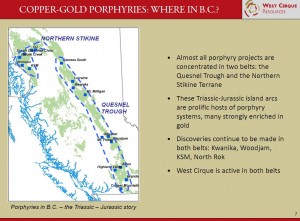

Freeport McMoRan is currently earning into three of West Cirque's projects by providing $1.5 million in exploration funding by the end of 2014. They can earn 51% in Castle, Tanzilla and Pliny by funding $8 million worth of exploration over a four-year period.

West Cirque has signed lock up agreements representing 21.3% and Kaizen's majority shareholder HPX TechCo is in favor of the deal.

Kaizen is led by CEO, Matthew Horner, who has been instrumental in Ivanhoe's access to Japanese capital. ITOCHU, the Japanese trading house, holds a 6.3% stake in Kaizen and is expected to vote in favor.

"The combination of Kaizen's existing portfolio of exploration projects in Australia and Africa and West Cirque's portfolio in Canada will establish a stronger company with an impressive and diverse pipeline of projects," Mr. Hornor said.

The combined company will have the same board as Kaizen currently has which includes Peter Meredith and Edward Flood both former Deputy Chairman of Ivanhoe Mines (IVN:TSX).

Kaizen currently has $13.4 million in cash which it intends to use to explore both Kaizen's existing portfolio along with West Cirque's assets using the geophysical technologies under license from HPX TechCo. This technology was used in the discovery of the enormous Oyu Tolgoi copper-gold porphyry in Mongolia.

Read: Kaizen to Combine with West Cirque in all-share Transaction and Expects Support from ITOCHU