There are a few interesting developments with regard to recent market volatility, both realized & implied. While realized equity volatility has been trending higher since early March, implied volatility (namely the VIX) has remained relatively muted and as of Thursday's close the VIX was on the verge of losing its 'teenager status once again:

Click to enlarge

While the VIX technically measures implied volatility of options prices on the S&P 500, it has historically held a very high correlation with the realized volatility of both the Nasdaq Composite and the Russell 2000 (small-cap index). The recent disconnect between the explosion of volatility in small caps (highest since 2011) and the dormant VIX is unusual to say the least:

While the VIX represents the market's expectations of future volatility 30 days out, it has generally had a very high correlation with realized volatility. In fact, the recent disconnect between realized volatility in small caps and implied volatility as represented by the VIX is the widest it has ever been.

Even moving the Average True Range (ATR) to a 7-day measurement, to better capture sharp changes in market volatility, illustrates that the current market episode is highly unusual:

This is made all the more interesting that we are fast approaching the beginning of the seasonally weak May-September "sell in May and go away" period for the market.

What is the explanation for the relatively low levels of implied volatility currently despite an ample amount of mounting warning signs? I believe the answer lies in recency bias; net buyers of hedges using put options have not done well in recent years as every shallow correction has given way to the next leg higher in equities. Market participants have now been trained to believe that dips will continue to be bought and that put hedges are an unnecessary expense which have only served to reduce portfolio returns.

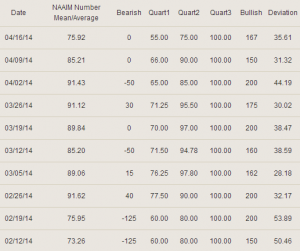

An exceptionally high level of complacency among market participants is also confirmed by the NAAIM Exposure Index which shows 0 bearish managers in its most recent survey:

This is quite a shift from January/February when the bearish reading registered -125 for four consecutive weeks.

Will the current market complacency get punished? Or will the dips continue to get bought up throughout the summer and into the fall? If history is any guide, adding some equity put exposure amid the mounting warning signs is probably not a bad idea.....