We are fresh back from a field trip to Curis Resources’ Florence copper project in Arizona.

Curis is deploying a strategy to: 1. gain permits for part of the operation; 2. prove that it is safe and viable; and 3. permit and build a larger operation.

Yet Curis shares trade for a fraction of what the company appears to be worth.

This is a boomerang for a looming miner that is well run and has a project with the lowest quartile all-in operating costs. Curis is on the verge of receiving final permits to begin construction. The snag: local opposition based on unfounded fears of underground water contamination.

Curis Resources Inc (TSX:CUV) is a Hunter Dickinson (HDI) group company founded in 2010 and taken public in 2011 at $2 per share. The company has 74 million shares outstanding (80 million F/D), and last traded at $0.79 cents, which gives it a market cap of approximately $60 million Canadian. Curis has roughly $23 million in cash and committed funds (which includes a remaining $18 million of a $40 million debt facility from Red Kite Mine Finance).

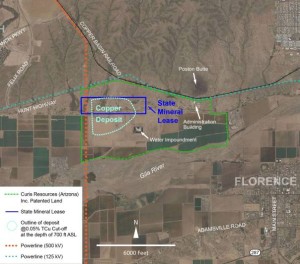

The Florence project hosts 340Mt at 0.36% copper in oxide bedrock containing more than 2.4 billion pounds of copper in NI 43-101 compliant probable reserves. The company expects to produce 42,500 or more tonnes of copper cathode per year when peak production is hit.

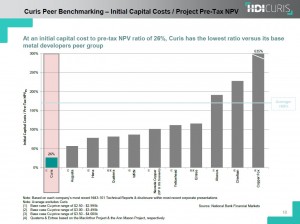

Florence will be a lowest quartile cost producer with C1 (processing, transportation, labour, etc) costs of US$0.80 per pound and C3 (all-in, including sustaining capital, royalties, taxes, etc) costs of US$1.10 per pound.

To put Florence into development, management envisions a two-phased approach whereby Curis will produce 1,000 tonnes of copper cathode per year in a trial mining scenario that will cost $35 million and last for 18 months. Most of the equipment is already on site and paid for.

By 2017, the company hopes to ramp up to 27,500 tonnes (55Mlbs) of copper per year for a modest capital spend of $208 million. This will commence in 2017 or 2018 (depending on permits) which will be operational at that (27.5Kt/year) capacity for 6 years and then will be further ramped up to peak production of 42,500 tonnes (85Mlbs) per year by 2023. The final stage will be in operation for 15 years and will only cost $31 million more in capex.

Using a $2.75 per pound copper price, the 2013 prefeasibility study outlined a post-tax NPV of $503 million and a 29% IRR over a 25 year mine-life for the Florence Copper project. Florence project has a 2.6 year payback (3 years post-tax).

Curis will produce cheap copper because of a unique, permeable geology. Most of the copper is in chrysocolla and occurs in veins or as fracture fillings. The thickness of the oxidized zone ranges from 100 to 1,000 feet with an average thickness of 400 feet. This enables the company to leach and extract the copper in solution, and in the ground.

Underlying the oxide mineralization are sulfide (hypogene) and enriched (supergene) zones. In most instances, the transition from the oxide to the sulfide zone is abrupt. Such a geological setting makes the project amenable to In-Situ-Copper-Recovery (ISCR). This abrupt sulfide layer protects the ground (and any groundwater) beneath the extraction zone.

ISCR is unlike traditional open pit or underground mining operations. An injection well pumps a solution of 99.5% water and .05% sulphuric acid (similar pH level as household vinegar) into the deposit (similarly to a traditional heap leach except underground). This dissolves the copper into a pregnant solution, which is then pumped out of the ground using recovery wells.

Four recovery wells surround the injection well. Once pumped out of the ground, the solution is piped to a solvent-extraction electrowinning (SX/EW) processing facility whereby copper cathode is produced and the solution (now free of copper) is recycled back into the system to be reused.

ISCR has been proven safe and effective in Arizona

In-Situ-Copper-Recovery is proven in several Arizona copper mining operations, including BHP’s San Manuel mine, where it is used as a secondary recovery method. Curis Resources' Florence Copper Project will be the first primary ISCR copper mine.

Major miner BHP Billiton owned the Florence Copper project in the 1990s. Low metals prices rattled the project. Florence has an estimated $100 million worth of infrastructure on it. We saw what 500,000 feet of drill core looks like (if laid out it would stretch from downtown Vancouver to north of Whistler).

Quarterly tests at Florence regularly show zero negative consequences from the operation.

Permitting

Since acquiring Florence, Curis has received water, air quality, sewage and other permits. Phase one construction hinges on an Underground Injection Control (UIC) permit from the Environmental Protection Agency (EPA), which is expected this quarter, followed by a 45 day comment period. Along with this approval: an additional $18 million of funding from the Red Kite facility.

Permits for phase two won’t be needed until phase one is in production.

Permitting has been delayed amidst state bureaucracy. In the housing bubble of the mid-2000’s, many USA states, including Arizona, annexed (essentially reclaimed and sold state lands) parts of the state for the development of housing complexes. After the bubble burst in 2008, many developers were in need of buyers. Enter Curis. In 2010, Curis bought the Florence project from a local land developer for $27 million.

Not in my backyard

The local developer along with a 76 year-old mayor and a minority of locals have been opposed to the Florence Copper Project ever since. The opposition comes for a project that was fully permitted in the 1990’s.

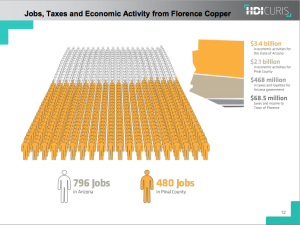

According to an independent economic benefits study of the Florence Copper Project by the University of Arizona in Tucson, the project will:

- Generate $2.1 billion in total economic activity in Pinal County alone

- Create and support 796 Arizona jobs and more than 25 years of full production

- Increase personal income in Arizona by $1.98 billion; of that more than $959 million will benefit Pinal County residents

- Create hundreds of new head-of-household jobs in Florence and Pinal County

- Provide approximately $468 million in taxes and royalties to Arizona governments

- Provide approximately $68.5 million in local tax revenues to the town of Florence

- Enable Pinal County and Florence combined to collect approximately $102 million in local tax revenues

To be sure, unforeseen permitting delays will hurt the company, which is burning roughly $800,000 per month.

Managers at Curis Resources have a sincere group of local citizens working on their behalf to win over the vocal minority. The process has been slow, but they have begun to make headway. The plan is to get the final, UIC permit, start producing safely in a pilot plant scenario at 1,000tpa and then build the trust of the community to get the second stage permitted and built.

If the company can successfully highlight the low impact the project will have along with the local jobs it will create, then Curis should have an easier time with the second stage.

As with any underground development, people are weary of water contamination and rightly so. With the geology and technology the Florence project has, I can’t foresee that being an issue. However, perception is reality and the company must win over local perception which they intend to do with the pilot plant.

The Curis technical team is extremely knowledgeable on ISCR mining and metallurgy. Hunter Dickinson co-Chairman David Copeland has now taken over as President and CEO from Michael McPhie, who left Curis shortly after our visit to pursue a new opportunity. He told CEO.CA that the company was strong without him: "Curis won't miss a beat." Mr. Copeland is an integral part of mine development in the HDI group.

Curis will be generating in excess of $100 million in EBITDA annually (at $3/lb copper). We expect that management will try to add value through M&A transactions down the road.

Overall, the company has only a few small permitting-related hurdles to get over and then they will be producing copper for the next 25 years at some of the lowest operating costs in the industry.

What’s more, management has signed a right of first refusal with KGHM for the purchase of its SX/EW plant from the Carlota mine in nearby Globe, Arizona. This dramatically will reduce $66 million Curis currently has earmarked for a new SX/EW plant.

Curis has already been through permitting and development delays and is now entering the next phase. This is where resource companies typically see the largest and most sustained appreciation in share prices, and Curis, we believe, should and will be no different.