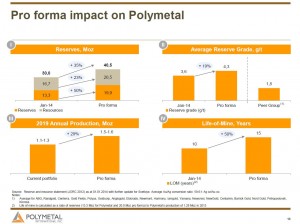

According to an announcement from London-listed Polymetal International PLC, the company has entered into binding agreements with Sumeru Gold B.V. and Sumeru LLP to acquire the Kyzyl gold project in north-eastern Kazakhstan for $618.5 million. The project hosts a 6.7 million ounce deposit (average grade of 7.5g/t gold) which will immediately double Polymetal's booked reserves. Kyzyl is one of the highest-grade and largest undeveloped gold projects in the world.

On a per ounce in the ground basis, the acquisition represents a price of $92/oz which is on the low end of the average, especially when you consider the size and grade of the deposit.

AuRico bought Young-Davidson from Northgate Minerals in late 2011 for $390 per reserve ounce. More recently, Primero's acquisition of Black Fox from Brigus Gold was done at $333 per reserve ounce in the ground.

This announcement by Polymetal comes just a day after Rio Alto (RIO:TSX) agreed to buy Stan Bharti's Sulliden Gold and its Shahuindo gold project in Peru for $300 million (closer to $350 million including spin-out). Shahuindo hosts 1.026 million ounces of oxide ore in the reserve category, meaning Rio Alto is paying roughly $300/oz in the ground.

These two M&A transactions represent what could be considered a consolidation period in the gold sector. Newmont has been finding buyers for their divestitures and Waterton and other private equity buyers are acquiring assets.

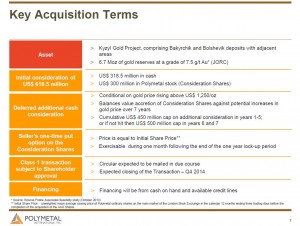

Polymetal will pay $318.5 million in cash, another $300 million in shares and up to an additional $500 million which is dependent on the relative dynamics of the gold price and the price of Polymetal’s shares over the next 7 years.

The acquisition is not only cheap on a per ounce basis, but also expands reserves by 50% (Source: Polymetal International PLC)

Vitaly Nesis, CEO of Polymetal said: "The Kyzyl Project fully meets our definition of a suitable acquisition opportunity: a large, high-grade asset with a clear path to production and cash flow generation leveraging Polymetal’s core strengths in selective mining and refractory ore processing. We believe it is an excellent chance to deploy our skills in a long-term project that can generate substantial value for our shareholders”.

Vitaly is the younger brother of one of Polymetal's largest shareholders, Russian billionaire Alexander Nesis who sold his stake in Uralkali for a reported $2 billion.

Polymetal will revise the feasibility study and look to bring down the $1 billion capex figure as well as increase the mine-life through upgrading resources to in pit reserves. They are also looking at developing part of the project as an open-pit as opposed to an underground mine.

It is expected that the project will produce 300-400,000 ounces of gold annually.

Polymetal has $1.3 billion in undrawn credit facilities which it intends to use for the initial cash payment.

Read: Acquisition of the Kyzyl gold project in Kazakhstan for an initial consideration of US$618.5 million

Here's the LINK to the webcast.