YPF is Argentina's largest oil producer and includes Carlos Slim as an 8.4% shareholder (Photo: Walter Moreno/Bloomberg)

In a note late last week, we noted that Madalena Energy (MVN:TSX) was the only junior with significant leverage to Argentina's massive oil and gas reserves. The company is about to increase its leverage in the country by acquiring Gran Tierra Energy's (GTE:TSX) entire Argentinian oil and gas business unit for $63 million in cash and stock. Madalena touts this acquistion as a 'transformational deal' and I agree.

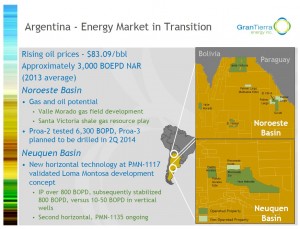

Madalena is gaining over 6,513mboe of 2P reserves, 3,300boe/d of production (78% oil) in 11 exploration and production blocks comprising 890,000 net acres of highly prospective land. In the Neuquén Basin, recent transactions have been valued at $7,000 to $10,000 per acre.

After the transaction is closed, the combined company will have over 1 billion net acres of land, 11,161mboe of 2P reserves and 4,900boe/d of average daily production.

These assets represent low decline, stable production assets that include an inventory of low risk development opportunities. Operating netbacks for the wells Madalena is acquiring are in the $33/boe range which should provide around $40 million in operating cash flow this year.

Madalena isn't giving away the farm to do it either; they are paying a total of $63 million to Gran Tierra comprised of $49 million cash and 27.7 million shares at a deemed price of $0.55. Madalena's last financing was done in January 2014 and was a $20 million bought deal at $0.70 per share.

The metrics look great:

- $19,000 per flowing boe

- $9.70 per 2P oil reserves

- Reserve Life Index of 5.41 years (based on current production and 2P reserves)

- 2P reserves/share goes from 11.2 to 20.6 boe per mm shares (an increase of 87%)

- Current production/share increases from 3.9 to 9.2 boe/d per mm shares (an increase of 138%)

Mr. Kevin Shaw, President and CEO of Madalena commented: "Madalena is very pleased to enter into this transaction, which is expected to simultaneously accomplish several steps in building value for Madalena shareholders. The combination of achieving critical mass in Argentina and the addition of a fully integrated professional and operating team in country will assist Madalena in accelerating a growth strategy that is balanced between conventional production focused development, and the delineation of the Company's unconventional shale and tight sand resources."

"I look forward to having the Argentina based Gran Tierra team join us in delivering this conventional growth and assisting us in the delineation and prove-up of Madalena's unconventional resources."

Gran Tierra's Argentinian assets will add 3,300boe/d of production to Madalena (Image: Gran Tierra Energy Inc.)

Gran Tierra had a 2014 capital budget for its Argentinian assets of $48 million for the year, of which they have spent $6.5 million already this year. Madalena believes, with its cash flow generation, it will be able to spend between $50 and $60 million this year on these assets.

Madalena is doing a concurrent $50 million bought deal financing being led by Dundee Securities (also acting as Madalena's financial advisor on the deal). The company will issue 90.91 million subscription receipts at $0.55 per receipt (the receipts are exercisable into one share upon closing of the deal).

This deal looks like a classic case of 'one man's trash is another man's treasure' as the it frees up capital for Gran Tierra to focus on their productive assets in Colombia, Brazil and Peru while at the same time offering an accretive deal to Madalena shareholders.

Gran Tierra has successfully grown reserves from 3 million to 42.1 million boes in seven years in Latin America and are targeting 23,500 to 24,500 boe/d this year (prior to this sale).

We offer fresh cut bank instrument for lease/sale, such as BG, SBLC, MTN, Bank Bonds, Bank Draft, T strips and other. Leased Instruments can be obtained at minimal expense to the borrower compared to other banking options and we also discount/monetize BG’s.

This offer is open to both individuals and corporate bodies.

If in need of our services, contact me for detail information.

Thank you,

Mr.Joe Duane

email.:jduane076@gmail.com

Joeduane@consultant.com

We offer our financial instrument- lease BG/SBLC for such business covering Aviation, real estate development, oil and gas, bio tech, heavy construction involving dams, irrigation scheme, Hospitality, Foods industry, telecoms, laboratory etc.

For further details contact us with the below information….

Contact : Mr. Petrovic Dorde

Email: directmandate@gmail.com

Skype ID: petrovic.dorde