The developer of the Soledad heap leach gold project in California, Golden Queen Mining (GQM:TSX) announced this morning that they have agreed to sell 50% of the project to an insider group for $110 million in cash. The insider group includes long-time shareholders from the Clay family (East Hill Management LLC) as well as the Leucadia National Corp. (NYSE holding company with major holdings in mining, banking etc., including Fortescue Metals and Jefferies). The investor group and Golden Queen will set up a 50-50 joint venture on the project upon closing.

Leucadia will own 67.5% of the 50% joint venture and the Clay group will own the other 32.5%.

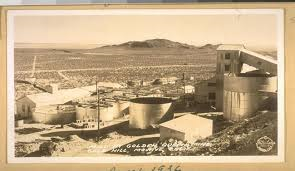

Golden Queen investors have been waiting for clarity on the financing plans for the Soledad project which sits just 90 miles northeast of Los Angeles. According to the company's 2012 Feasibility Study, the Soledad project would cost $120 million in initial capex (assuming owner-operated mining).

The company had $13 million cash and $20 million debt prior to this transaction with Leucadia and the Clay family. Permits have been granted and the project is now construction ready, with commissioning of the processing facilities planned for 2015.

Based on the 2P mineral reserves hosted on the Soledad project, the insiders are paying approximately $175 per proven and probable ounce in the ground which puts it inline with the average.

To secure all of the funding necessary, Golden Queen is also undergoing a rights offering which is being backstopped by Leucadia and the Clay family for $45 million (at $1.10 per share). As part of the deal, the investor group has also agreed to spending up to an additional $40 million.

Lutz Klingmann, president of Golden Queen, commented: "We believe that this transaction allows the Soledad Mountain project to enter full construction after decades of patient effort. The company is delighted to enter into a joint venture with Leucadia, whose well-known, disciplined capital allocation procedures fit well with what we hope to achieve at Soledad Mountain. We believe that a low-risk, equity-based capital structure is the prudent approach to managing the risks of the construction stage. If and when in production, we look forward to re-examining the capital structure to determine whether or not returns to equity investors can be enhanced through leverage."

The Soledad project's risk profile increased recently, when a petition was put together which would see the Mojave Shoulderband Snail become an endangered species which could dramatically impact the operations of Soledad (should the snail be granted endangered status).

The project is an extremely economic one with a 15 year mine-life producing 77,000 ounces of gold per year at sub $600/ounce all-in sustaining cash costs. The after-tax NPV(5%) is $427 and an IRR over 44% (based on $1300/oz Au) which puts it in the top quartile for project returns.

Read: Golden Queen Announces Joint Venture to Develop and Operate the Soledad Mountain Project