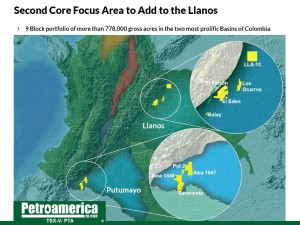

The combined company would have significant acreage in both the Llanos and Putumayo Basins (Image: Petroamerica Oil Corp.)

Today, Petroamerica Oil (PTA:TSXV) got a vote of confidence for their bid for Suroco Energy (SRN:TSXV). ISS Proxy Advisory Services published a report recommending Suroco shareholders vote in favour of Petroamerica's share offer which valued the company at roughly $0.573 per share (or 1.7627 Petroamerica shares for each Suroco). This was quickly followed up with a news release from Suroco's management and board recommending that shareholders of their company do the same.

A competing bid for the Colombian light oil producer came out of the woodwork last week from VETRA (a private E&P) which offered Suroco shareholders $0.60 cash per share for their valuable acreage and assets in the highly prospective Putomayo Basin. VETRA and Suroco are partners of a block in that basin and obviously their bid for Suroco validates Petroamerica's desire to get into that area.

ISS is the world’s leading provider of corporate governance solutions for asset owners, investment managers, and asset service providers and serves 1,700 clients in over 115 global markets.

In its June 9th report, ISS concluded that the proposed arrangement transaction between Suroco and Petroamerica makes strategic sense as Petroamerica is a much larger and well-established player in the same segment and further concluded that in light of the significant implied premium, the favourable market reaction, and absence of significant governance concerns, approval by Suroco shareholders of the arrangement with Petroamerica is warranted.

Following the announcement by ISS, Suroco's management and board released a comprehensive news release outlining, in detail, the reasons for rejecting the VETRA offer and for accepting Petroamerica's.

Commenting on behalf of Suroco's Board of Directors, Daryl Gilbert, Chairman of Suroco said, "While the Board is pleased that Vetra has finally started to acknowledge the value of Suroco, the Board continues to believe that the proposed strategic business combination transaction with Petroamerica Oil Corp. is in the best interest of shareholders and continues to recommend that Suroco shareholders vote in favour of the transaction with Petroamerica at the June 25, 2014 meeting of shareholders of Suroco. As we set forth in this press release, Vetra's previous offers to acquire Suroco were consistently lacking in both clarity and any material premium and do not provide shareholders the ability to retain ongoing exposure to the exploration potential that shareholders will be able to participate in under the transaction with Petroamerica. Besides setting forth some of the reasons to reject the Vetra Offer, the Board would also like to take this opportunity to address some of the inaccuracies found in the Vetra Offer and to set the record straight."

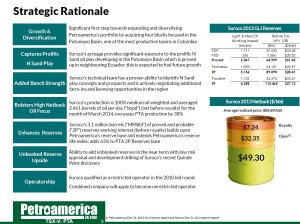

This should give a boost of confidence to the Petroamerica offer which has, in our opinion, the ability to transform the combined Petroamerica into the next category of Colombian light oil producer with significant opportunities in tested and untested formations in the two most prolific basins in the country (Putumayo and Llanos). Production from the combined entity is estimated to be nearly 9,000boe/d and have 8MMbbl of 2P reserves, which allows the company to generate significant free cash flows to explore new formations in the Putumayo and to continue growing in the Llanos basin.

Petroamerica has big plans for the combined assets which the team there believes is capable of driving continued production and reserve growth as well as allows them to become operators (which will allow them to become operators on more assets, because once you're an operator on one you can become an operator much more easily on another block in Colombia).

Petroamerica has delivered quarter-over-quarter production growth from the Llanos Basin with many of its wells now entering the 'printing money phase' whereby the wells require little capital and have repaid their upfront costs and are now generating real free cash flows. The $200 million market cap company already has over $105 million cash on hand today and expects to generate $100 million in cash this year (excluding the Suroco acquisition).

While many domestic producers trade at over $150,000 per flowing barrel, Petroamerica trades at roughly $16,000 per flowing barrel (on an enterprise value basis) and a measly ~1x 2014 cash flow. While in the mining business these days, cash is king, for shareholders of Suroco that is likely not the case when you compare it to owning shares in Petroamerica.

The deal is expected to close June 30, 2014 and now awaits the decision from Suroco shareholders.

Click HERE for the Petroamerica presentation on the Suroco/Petroamerica merger.

Disclosure: I am long Petroamerica Oil and am therefore biased. Nothing in this article should be considered investment advice. Always due your own due diligence.