Australian-listed Highfield Resources (HRF:ASX) received another vote of confidence from their largest shareholder, Owen Hegarty's EMR Capital. The Australian-based private equity group (EMR Capital) became a substantial shareholder in the company last year with the hopes of turning a big profit with a series of Spanish potash projects Highfield holds.

EMR increased their holdings in Highfield by adding another 25 million shares to their position in Highfield, bringing their total ownership up to 32.5% on an undiluted basis and 20% on a F/D basis.

EMR's recent acquisition was part of a larger, institutionally-focused, equity raise done at AUS$0.48 which raised a total of AUS$32 million or 65 million shares.

This marks a continued interest in agriculture stocks from the sophisticated mining investment community.

When we last spoke with Appian Capital's founder, Michael Scherb a few months ago (Read our interview HERE), he noted his firm's interest in the agriculture sector. Mr. Scherb and his team are looking all over the Americas and Africa for the best mining investments, including potash (note, their investment in Roxgold is up over 32% since they acquired their most recent position in March).

Highfield intends to use roughly $15 million of the raise to advance their Javier project by purchasing long-lead items and further developing the project. They will spend another $10 million on their other two Spanish projects (part of of the funds will be used for a maiden resource estimate at their Sierra del Perdon project).

EMR, remained committed to the deal and took their 25 million shares at a premium to the rest of the financing (EMR participated at $0.51 versus the rest of the investors at $0.48 per share).

EMR is led by Owen Hegarty who is an ex-Rio Tinto Managing Director and founder of OZ Minerals. He is on the board of Fortescue Metals, one of the largest iron ore companies in the world, as well as Chairman of Tigers Realm Minerals (you might recognize the name from NexGen Energy as Tigers Realm are a large investor in that Athabasca uranium explorer).

Mr. Hegarty is also a director of Highfield Resources.

Anthony Hall, managing director for Highfield, commented: “We are delighted with the support received from both Australia and offshore institutions as a part of the capital raising. The extent of this support has demonstrated confidence in the robustness of our projects. The successful capital raising will allow us to now develop the Spanish potash projects with the ultimate aim of commencing construction at Javier in 2015. We have three fantastic potash projects that we are looking forward to developing into mines over the coming years.”

Highfield raised the AUS$32 million to bring their three 100%-owned Spanish potash projects closer to production. Their most advanced asset is Javier which hosts over 268.6Mt of 11.2% K2O and 17.8% KCI.

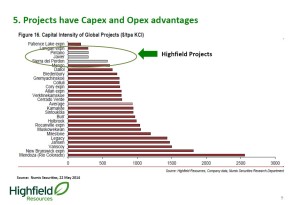

The project will cost US$308 million to build and is estimated to produce over 860Kt of potash per year during a 20 year mine-life. The after-tax NPV(10%) is US$1.068 billion and IRR is 48.4%. The company expects to be in production by mid-2016 with full production by 2018.

Highfield also has two other projects (Pintano and Sierra del Perdon) which, combined, host an additional 187Mt of 11.2% K2O and 17.8% KCI. The company expects to release the maiden resource estimate for the Sierra del Perdon project this year.

As they say, the 'smart money is first'. And that money looks to be making a collective bet on a growing global population and the need to increase productivity of agricultural land.

Read: Highfield Completes $32M Institutional Equity Placement