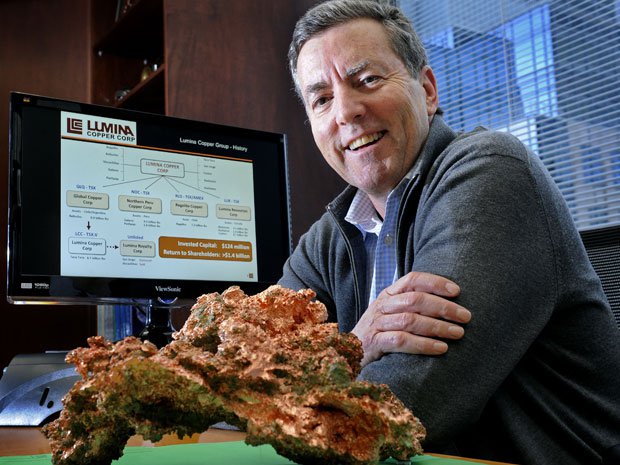

As reported earlier this morning, Lumina Copper, was halted pending news and most people familiar with the story anticipated that it would announce a take over. We suspected a Chinese bidder, but also cited First Quantum as a potential buyer and that's exactly who has stepped up to acquire Ross Beaty's Argentine copper developer for $470 million in cash and stock.

Each Lumina share, of which founder Ross Beaty holds 9.7 million or 22%, can elect to take $10 per share in cash or $5 per share cash and 0.2174 First Quantum shares or $0.01 per share in cash and 0.4348 First Quantum shares. The $10 cash offer represents nearly a 30% premium to yesterday's close.

Mr. Beaty's holdings (according to company filings) will provide him with another $100 million. Not a bad Tuesday morning.

Taca Taca is located just 120km east of the world's largest producing copper mine, Escondida. In it, First Quantum is acquiring over 21.15 billion pounds of copper in the indicated category and an additional 7.55 billion pounds in inferred. First Quantum already owns 2.5 million shares. Using an all-in metric, First Quantum is acquiring Lumina for $1.36 per pound:

| Enterprise Value/lb* | $0.022 |

| Capex/lb** | $0.140 |

| Sustaining Capital/lb** | $0.085 |

| Opex/lb** | $1.110 |

| Total Price Paid per Pound | $1.357 |

| *Based on $470M acquisition value | |

| **Based on 2013 PEA |

Commenting on the proposed transaction, Mr. Ross Beaty, Lumina's founder and largest shareholder said, "I am very pleased with First Quantum's proposed acquisition of our company. First Quantum is an outstanding mining company with a significant and growing portfolio of copper operations. In our view, they are the most capable company in the world to develop Taca Taca into a major copper mine. This transaction provides Lumina shareholders with the option to retain exposure to Taca Taca's future development in the hands of a world class mine development and operating team through ownership of First Quantum's shares. I encourage all Lumina shareholders to vote in favour of this transaction."

Including First Quantum, Ross Beaty and other insiders, 33.6% of shareholders have signed lock-up agreements. Should the deal fall through, Lumina will owe First Quantum a cash break-fee worth $16.25 million.

Shares have just resumed trading and are up 25% or $1.91 per share to $9.71. Here's the one month chart:

A replay of the conference call is available:

Dial in: 905-694-9451 / 800-408-3053 (North American toll free)

Pass Code: 6198300

End Date: July 1, 2014