Torex Gold (TXG:TSX), the owner and developer of one of the richest undeveloped open-pit gold mines in the world, has provided an update on how well the development of their Morelos project in Mexico is going (start-up scheduled for late 2015) as well as the latest results from their infill drilling program.

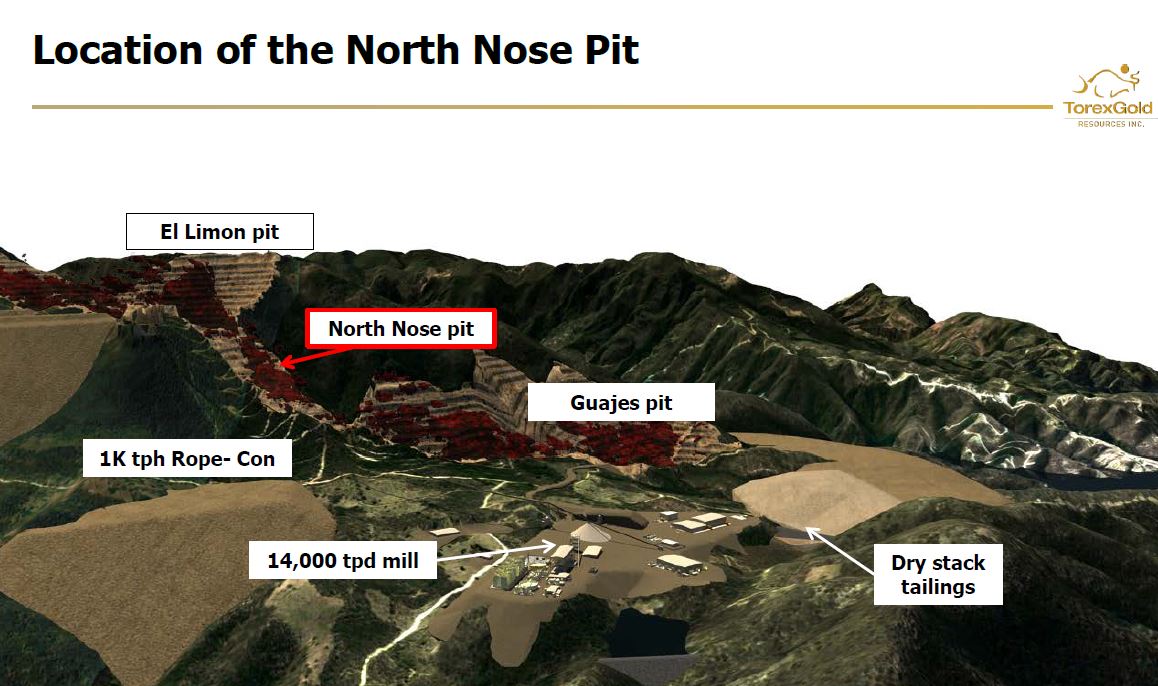

The company has begun mining at the North Nose pit and will be adding approximately 72,000 ounces of mined and stockpiled material into the 2015 processing schedule. These ounces have been reengineered to be brought forward from the tail end of the production schedule (as shown in the feasibility study). This material is in addition to the previously planned 38,000 ounces of 2015 production from its El Limon-Guajes project in Mexico.

This new mining face will help ramp-up the mine more quickly. With this additional 72,000 ounces, the mine is expected to produce over 100,000 ounces of gold in 2015, 168,000 in 2016 and then up to over 350,000 ounces by 2017 (steady-state). The slower ramp-up which is estimated at over 2 years is due to a lack of available mining faces and not as a result of mill capacity. Once fully ramped up the plant will process 14,000tpd by 2017.

According to the release, management expects mining at the North Nose pit to have an average grade of 2.9g/t gold and to be mined at a strip ratio of 1.9. Given this lower strip and higher-grade ore, economics in the first year should improve dramatically.

Fred Stanford, President and CEO of Torex, said: "Now that the operators and engineers are on site and developing into a team, they have been able to design a mining approach for the North Nose pit that will work in concert with the construction of the rope conveyor. With this good work to enhance early cash flows now complete, they will turn their attention to doing the same with the El Limon Sur deposit, for the 2016 portion of the ramp-up period. Construction of the El Limon-Guajes project continues to advance on schedule and on budget."

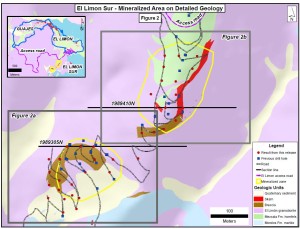

Torex intends to do the same thing with the El Limon Sur deposit and is working to move tail production forward in the processing schedule.

"The proximity of El Limon Sur to the El Limon access road and the near-surface nature of the mineralization, make El Limon Sur an excellent potential source of additional feed for the processing plant during the ramp-up period." He added, "In order to minimize risks to the schedule, the process for developing the permit applications is already under way," said Mr. Stanford.

In a release today, the company released the final drill results from infill activities and a new development at the mine site which should enable the company to access more ore in the early years at El Limon Sur.

Highlights include: 12.3m of 22.2g/t gold and 34.1m of 7.2g/t gold which are largely inline with other recent drilling, but higher grade than the current inferred resource which averages 2.72g/t gold (in 2P reserves).

El Limon Sur looks like it provides the ability to increase production in year one, similarly to what North Nose has done (opening up another mining face early).

Management expects to release an updated resource estimate for this zone this summer which should see much of the inferred transferred to measured and indicated categories.

Furthermore, Torex expects to release an updated mine plan in early 2015 which should incorporate these revised production schedules.

Recall, the company is fully financed for the development of Morelos (the first mine). Media Luna, the company's exploration project and what they call their 'second mine' now hosts over 5.8 million ounces of inferred gold equivalent ounces at an average grade of 4.55g/t.

Torex has 59,915,000 $1.50 warrants that expire August 12, 2014. It looks like these will be exercised (given shares are trading 8% above exercise price) which will provide the company with an additional $90 million.

Given the project's unique size, grade, operating costs (lowest quartile) and the fact it is in a stable jurisdiction (Mexico), this would be a prime takeover candidate.

The company has already seen a recent rebound in its shares after hitting lows of $0.85 per share earlier this year.

With production less than 12 months away, I would expect that upward trend to continue, especially if the warrants are exercised. That will provide investors with confidence that Torex is truly fully funded (some have questioned whether they actually had enough to complete the build).

Here's the 3-month chart:

Also: Torex Completes Infill Drilling Program at El Limon Sur