(Suroco shares are currently trading at $0.83 per share, indicating the market currently anticipates Petroamerica's offer will win.)

This morning, VETRA, the private Colombian oil company that is in a battle over Suroco Energy (SRN:TSXV) with Calgary-based Colombian light-oil producer Petroamerica Oil, raised their cash bid for the company to $0.85 per share, representing a small, 2.4%, increase to their previous offer of $0.83.

The $0.02 per share cash increase in VETRA's offer is eclipsed by the potential accretion a share transaction with Petroamerica would create.

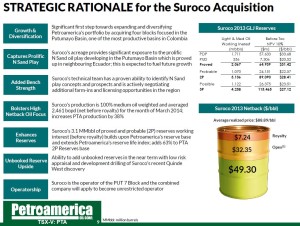

What's at stake is Suroco's Putumayo Basin assets, including the N-Sands play which has been hugely successful across the border in Ecuador. This play-type is largely untested in Colombia, but Petroamerica's team believes it has huge potential (as do many analysts) and that Suroco shareholders should continue to participate in it.

In a recent statement, Petroamerica's management highlighted the fact that “research analyst’s target prices for Petroamerica imply $0.98 per Suroco share of potential value to Suroco shareholders.”

Suroco's management will likely respond to this raised offer within 48 hours, but currently the Board and management of Suroco officially support Petroamerica's bid which currently offers Suroco shareholders either 2.2161 Petroamerica shares for each Suroco share, $0.80 per share in cash or a share and cash combination.

I wouldn't expect this small increased bid to sway Suroco's support for Petroamerica's offer.

Suroco highlights the fact that the combined company creates long-term value for shareholders given the fact that "it (the combined company) would hold interests in 11 exploration and production contracts focused on high-netback light oil in the Llanos and Putumayo basins in Colombia."

Petroamerica trades at a deep discount to its peers despite having some of the most profitable production in Colombia and significant exposure to Colombia's most prolific basin (Llanos). One reason for this discount is the fact the company lacks operatorship of its assets currently, but through the acquisition of Suroco Petroamerica has a clear path to gaining operatorship in the future.

In combination with Suroco's asset base, Petroamerica's management envisions a company with average daily production of 30,000bpd (up from the current combined production of roughly 9,000bpd) by 2018.

We have contacted Jaimie Sommerville of TD Securities who currently has a $0.60 price target for Petroamerica (without the Suroco assets), but have not heard back at press time. We will update when we hear back from him.

Suroco shareholders are set to vote on Monday, July 14, 2014 at 10:00AM (Calgary Time).

Read: VETRA Increases All Cash Binding Offer for Suroco to $0.85 per Common Share

Related: Too Much Upside Left in Suroco to Sell Out Now Says Petroamerica Chairman