Since an unprecedented staking rush in 2010 that had not been seen since the Klondike Gold Rush, the Yukon has fallen out of favor with many mining and exploration investors due to its short seasons and expensive work programs.

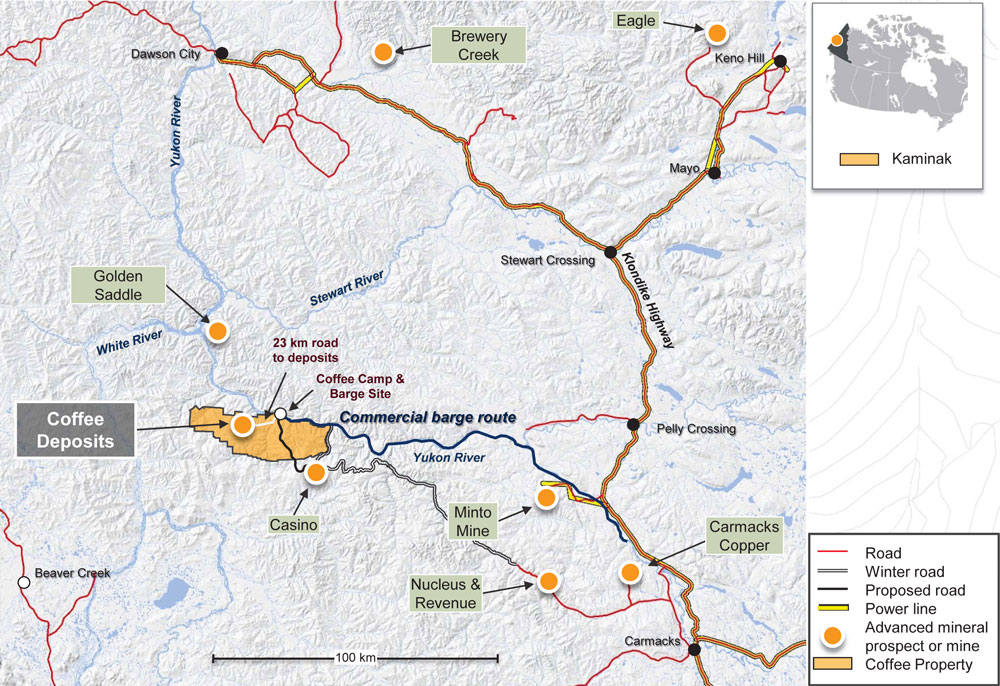

One company that has continued in the land of the midnight sun is Kaminak Gold (KAM:TSX), which discovered the Coffee Gold project amid the staking rush of 2010.

This morning both Coffee and Kaminak got a huge vote of confidence. Two very good friends, each incredibly successful mining investors, have acquired minority stakes.

Lukas Lundin (through his family's Zebra Holdings and Investments S.à.r.l., Luxembourg) and Ross Beaty have both agreed to invest $6.76 million, or $13.52 million combined, at $0.80 per unit, with each unit coming with one share and one half of one one-year warrant (exercisable at $1.20).

Lundin and Beaty will each own 9.98% of Kaminak after the financing closes.

After the financing, Kaminak will have over $26 million in cash giving it an enterprise value (theoretical takeover value) of <$60 million.

Eira Thomas (daughter of diamond legend Gren Thomas), Kaminak President & CEO, commented, "Kaminak is very pleased to be welcoming both Ross Beaty and Zebra Holdings as significant new shareholders, at a pivotal time in our Company's history. Kaminak recently completed a Preliminary Economic Assessment for our Coffee Gold Project, which indicates a robust, high margin, rapid pay-back, 11 year, open pit, heap leach project in Canada at current gold prices. The Company will now have sufficient funds on hand to undertake a bankable feasibility study and advance the project towards a production decision."

Ms. Thomas sits on the board of Lundin Group Company, Lucara Diamond.

Mr. Beaty is coming off a couple big wins including his ~10% stake in Augusta Resource which agreed to a friendly takeover by Hudbay Minerals for $555 million in stock. Just prior to that announcement, he agreed to sell his 22% stake in Lumina Copper as part of a $470 million takeover bid from First Quantum Minerals.

Mr. Beaty could realize some $150 million in dispositions as a result of the two transactions.

On June 10th, Kaminak released a PEA for the Coffee project which currently hosts over 4.2 million ounces of gold. The PEA illustrated a mine producing gold at an average of 167,000 ounces per year for over 11 years at all-in sustaining cash costs of $688 per ounce. The project is set to be a standard heap leach project but has an above average gold grade (1.23g/t gold) and good recoveries (88%).

Using $1,250 per ounce gold, the project generates an after-tax NPV (5%) of $330 million, IRR of 26.2% and is expected to payback the $305 million in initial capex within 2 years.

Of the Coffee deposit, Eira said: "Further upside to this evaluation is anticipated through optimization studies and continued exploration. All of the deposits in the current resource remain open along strike and to depth.”

Shares are up 14% or $0.11 per share at the time of writing (to $0.90 per share). In this environment, financings typically aren't followed by a positive share price bump, but when its Lundin and Beaty providing the capital, it is a different story.

Read: Kaminak Announces $13.5 Million Investment by Ross Beaty and Zebra Holdings and Investments S.à.r.l.

Also: Kaminak CEO Eira Thomas was interviewed by James Kwantes of the Vancouver Sun last week, check the story out here.