Last week, Kaizen Discovery (KZD:TSXV) held a conference call with President and CEO, Matthew Hornor to discuss the recent acquisition of West Cirque Resources, their strategic partnership with ITOCHU Corp and his company's plans for more acquisitions.

Last week, ITOCHU agreed to provide $4.25 million in funding to Kaizen (as part of the West Cirque deal) in order to earn an initial 40% interest (for $4 million cash) in the Aspen Grove project and a 15% interest (for $250,000 cash) in the Tanzilla project, both located in British Columbia.

Kaizen believes the projects could host a large copper-gold porphyry and they will be the operator of the exploration efforts.

The company has budgeted $1.3 million this year which includes detailed mapping and sampling at the Par and Ketchan Lake prospects on the Aspen Grove project as well as a small (1,500m) follow-up drill campaign on Par. They will also complete a 60 line kilometre 3D IP survey using their proprietary Typhoon technology.

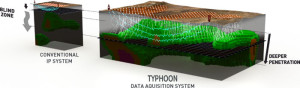

Recall, Kaizen has a service agreement with HPX TechCo whereby they can use HPX's patented Typhoon IP survey on their projects to more accurately identify ore bodies. HPX is indirectly controlled by resource financier and billionaire Robert Friedland.

Next year, Kaizen will complete at least 7,500m of diamond drilling at both prospects and are budgeting $2.7 million.

On the Tanzilla project, the first phase will be funded by US copper giant, Freeport-McMoRan. They can earn a 51% interest in the project by spending $8 million over a four-year term including $1.5 million within the first 18 months. Kaizen will operate this joint venture as well.

The acquisition of West Cirque is more significant than the assets it brings into Kaizen's portfolio.

HPX's Typhoon technology enables Kaizen to identify ore bodies that may otherwise be overlooked using traditional IP surveys (Image: High Power Exploration Inc.)

On the call, Mr. Hornor emphasized the fact that it demonstrates ITOCHU's eagerness to work as a partner with Kaizen to find eventual sources of off-take for their metals business. He says the backing of the West Cirque transaction should give investors comfort that ITOCHU intends to continue working with Kaizen to find and develop projects.

See link here on SEDAR for the framework agreement dated January 30, 2014.

"The framework agreement is a critical document that investors should read," Mr. Hornor told me by phone as he boarded a plane last week. I took his advice immediately after our call and read it.

In order to keep options open to both parties' the agreement is not meant to be a true partnership. Both parties will agree to each endeavour and decide whether or not they will participate. However, Mr. Hornor believes the expediency in which ITOCHU supported and now funded the West Cirque acquistion demonstrates their likeliness to participate in the next deal (and the next).

In the document it states that: "The Parties (Kaizen and ITOCHU) wish to collaborate in: exploring and developing Kaizen's existing and future mineral exploration projects; and evaluation additional mineral exploration opportunities and projects sourced by the Parties which may be suitable for the implementation of HPX TechCo Technology Cluster and/or which the Parties may wish to jointly explore and/or develop."

Translation: Kaizen will find projects and ITOCHU will fund them.

The Japanese conglomerate wants feed for their metals business and is obviously comfortable waiting.

Mr. Hornor made it clear that he and his team are currently searching for the next acquisition and they expect to announce more this year.

"We like Peru and Chile," Mr. Hornor stated on the call.

Kaizen was in the news again today as they appointed West Cirque's former VP Exploration, John Bradford, as their Chief Geologist.

Mr. Hornor stated in the release this morning: "We are very pleased to add John to our management team. He has a long and successful track record as a prospect generator and his depth of mineral exploration experience and management skills will be a great asset as we move forward with our exploration and corporate development plans."