After Asanko Gold (AKG:TSX) recently announced that its Board of Directors approved the Phase I build of their gold mine in Ghana, the company released better than expected metallurgical test results from the satellite, Dynamite Hill, deposit.

On July 17, Asanko announced that they got the green light to build Phase I of their Asanko Gold Project which is the old Obotan project (acquired from PMI Gold) from the Board. The company is fully-funded for the $295 million build and early works are already well underway, having started in April.

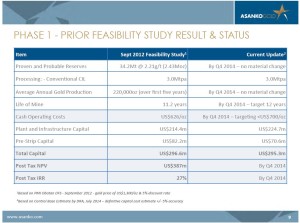

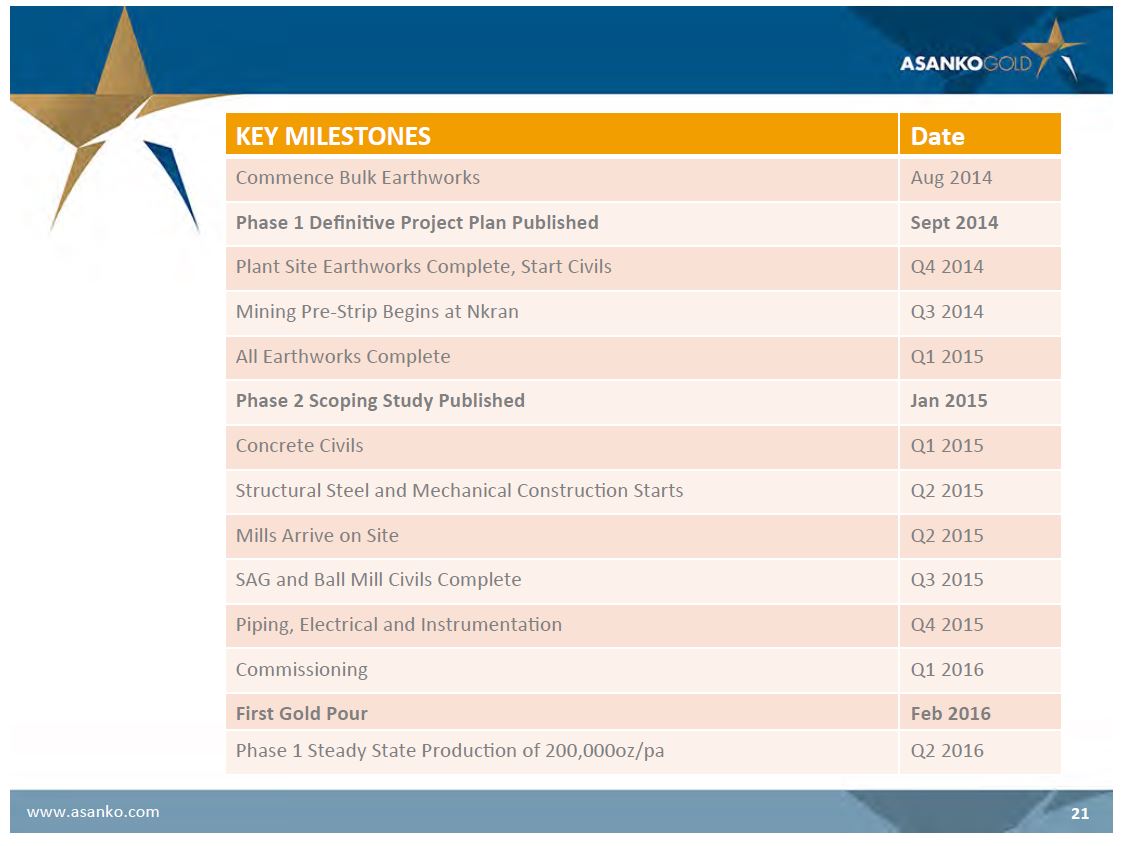

The company is working towards a bankable feasibility study for the project which it intends to publish by the fourth quarter which will include an updated mineral resource estimate, detailed engineering and updated operating costs for the Phase I project. By the end of the year, the company expects to have begun pre-stripping at the Nkran pit as well.

Asanko's President and CEO, Peter Breese, said in a recent statement: "With the project fully permitted, financed, and a team of experienced mine builders and operators in place, we will, in parallel with construction, continue with our growth strategy. In particular we have begun to evaluate the optimal way to implement phase 2 in order to bring to account the additional 2.2 million ounces of mineral reserves at Esaase, while capturing the synergies we forecast when we acquired PMI Gold and created the Asanko gold mine."

Phase I is expected to pour gold in the first quarter of 2016 ramping up to steady-state production by the second half of the year. The 3Mtpa SABC whole rock CIL circuit is expected to produce an average of 220,000 ounces of gold per year over an 11 year mine-life at $626 per ounce cash costs. With the news today from the Dynamite Hill deposit, the Phase I mine-life could be extended.

Today, Asanko announced better than expected metallurgical results from their Dynamite Hill deposit which they are working to publish a maiden resource estimate on by September.

Dynamite Hill is a recently discovered near-surface gold deposit located 7 kilometres from the central Asanko Gold Project processing facility.

The material there has returned gold recoveries of between 93.2% and 96.2%.

These results have confirmed that the material from the Dynamite Hill deposit presents consistent and similar leach kinetics to the other deposits and should be able to be blended with other material in the central processing plant.

Gravity gold separation test work indicates that approximately 50% of the gold is expected to be recovered in the gravity circuit.

Asanko is working to not only advance Phase II of their Asanko Gold Project but also to bring Dynamite Hill into the mix with a definitive mine plan, which will be included as part of the overall definitive project plan for Phase I by the end of the year.

As the Dynamite Hill mineralization occurs near surface, management expects minimal prestripping requirements.

Asanko has $230 million in cash and a $150 million debt facility from Red Kite giving the company an enterprise value (EV) of $405 million.

On an EV/2P reserve ounce basis the company is trading at the lower end of the peer group at roughly $85 per reserve ounce.

Given the fact that company is fully-funded for the first phase of production, already well underway with early works and are growing the production profile of Phase I by potentially incorporating Dynamite Hill ore, this discount is unearned.

Obviously smart investors agree.

Their shareholders list includes institutions such as: JP Morgan, Sun Valley, Sprott and Van Eck and also heavy-weight resource investors such as Robert Disbrow (founded Haywood Securities' institutional business). Disbrow owns 5.3% of the company, or $24 million worth of stock.

Read: Asanko Gold Announces Positive Metallurgical Results from Dynamite Hill