Yesterday, Australian-listed MacPhersons Resources (no relation) announced that the mining-focused investment firm Orion Mine Finance which split off from Red Kite Mine Finance last year would be investing $6.5 million in the company.

Orion's team have been focused on loans and metal offtake agreements primarily. Since splitting from Red Kite, their largest deal was the $200 million loan and offtake agreement with Nevada Copper for their Pumpkin Hollow project.

The investment was part of a larger $10.4 million financing that also included MacPhersons Chairman Ashok Parekh also investing $1 million, personally.

Orion Mine Finance will become a 19.90% shareholder in MacPhersons as a result of this investment.

The financing was done at a slight, 8.5% discount to the prior closing price. At the $0.16 per share issue price, MacPhersons has a market capitalization of approximately $40 million with $12 million in cash after closing of the financing.

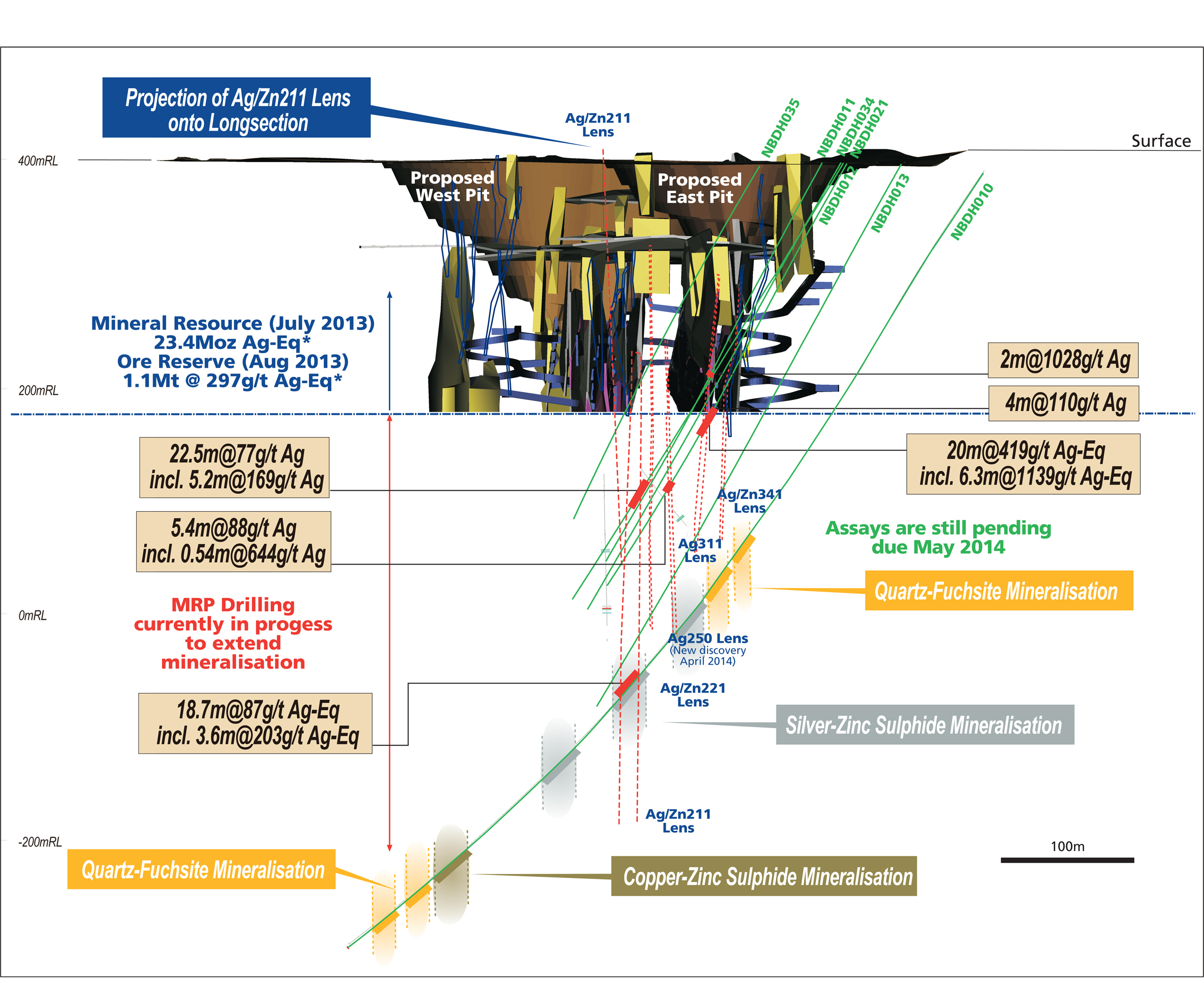

MacPhersons is raising capital to advance its Nimbus silver-gold-zinc project in the hopes of extending the known mineralization with more drilling at depth, finalizing the permitting process and completing a bankable feasibility study.

Nimbus is a past producing open-pit operation and the company has defined a significant extension to the mineralization at depth.

The project hosts 12.4 million ounces of silver, 460,000 ounces of gold and 65,000 tonnes of zinc.

Zinc has been a segment of the mining markets that has garnered quite a bit of attention as of late. Metals traders and investors, alike, are attempting to gain exposure to the commodity prior to a potentially large supply deficit later this decade.

The sophisticated money has continued to cherry pick stories that have strong operating margins. Typically these are the stories with the highest average grades.

Nimbus is a volcanic-hosted massive sulphide (VHMS) deposit which are polymetallic and often associated with high-grade mineralization.

The primary zinc-copper-lead-silver mineralization occurs at depth to 370 metres and up to 20 metres thick in places with VHMS breccia hosting high-grade mineralization with grades in excess of: >20% Zinc, >1500g/t Silver, >5% Lead and >6% copper.

In the previous economic study MacPhersons estimated capex of between $58 million and $66 million. The company believes the BFS will come in significantly lower than that.

The BFS is due by the end of the third quarter of 2014.

Read: MacPhersons to raise up to A$10.4m at 16c to complete BFS at Nimbus silver-gold-zinc project

Note - All figures in Australian Dollars, unless otherwise noted.