Copper has been on the rise since March, fetching more than $7,100/t, but the rally will end soon according to a report by Macquarie Capital titled “10 things we hate about copper - or why we reiterate a short in 2H." The price of copper is highly correlated with economic growth and earlier this week investors flocked to the metal following the recent U.S. GDP numbers, which were stronger than expected.

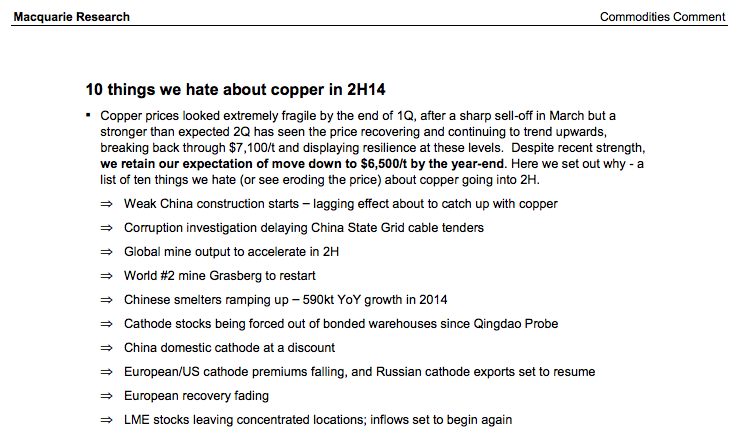

While data from the U.S. continues to support that a recovery is under way, Macquarie says there are bigger factors at play that will have an impact on the price of copper, noting that Chinese demand will soon decline and global supply will soon increase. Macquarie expects copper will sell for around $6,500/t by the end of the year.

China, the largest market for copper, accounts for 45% of global demand, and according to the Macquarie report housing starts were down year-over-year in each of the first six months of 2014. “Consumption lags building starts by a few months because wiring installation is a late-stage construction task.”

Also, the Chinese government opened an anti-corruption investigation related to the State Grid last March and total grid investment has since declined. About 30% of China’s copper demand accounts for investment in the government’s power grid. China, as always, has not said much about the investigation other than it has made one arrest, but its actions do not instil confidence that the government is in a hurry to buy more copper.

Concerning supply, Macquarie expects fewer outages at mines in the second half of this year and it has pointed out that Freeport McMoran has reopened its Grasberg mine, the world’s second-largest copper mine, and shipments will start in mid-August. Freeport shut down the mine six months ago following new mineral regulations in Indonesia but it has struck a deal on export taxes and royalties with the government that made Freeport happy enough to restart the mine.

As dedicated commodities speculators, we like a negative short term outlook for copper, because it allows us to pick up assets for cheap. Learn which ones by subscribing to Resource Opportunities, our premium newsletter ($299/yr here).