Morgan Stanley recently pegged the marginal cost of gold production at $1,254/oz, up from a previous estimate of $1,200/oz. With the gold price recently floating near $1,300/oz this poses significant challenges for higher cost miners who are struggling to maintain profitability. However, with every challenge there lies opportunity. For lower cost senior producers who are able acquire additional projects at attractive valuations and integrate them into their existing economies of scale that opportunity is NOW!

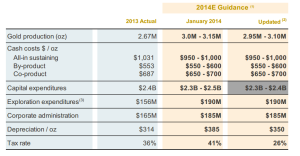

Goldcorp (GG) is one such senior producer that is able to thrive in the current gold price environment due to its lower cost of production:

Source: Goldcorp Q2 2014 Investor Presentation

Source: Goldcorp Q2 2014 Investor Presentation

During GG's most recent earnings conference call, CEO Charles A. Jeannes offered a strong hint that Goldcorp was on the lookout for acquisition opportunities:

"...we put ourselves into this position through a lot of hard work to get the operations running very well and efficiently and at low cost and to bring on the new projects so that we have the opportunity to continue to improve the company. And so the way we look at it is where are we going to allocate that free cash flow going forward? Of course, we're committed to our dividend and we'd like to grow that dividend, but we also have a series of exciting new projects coming up organically within the organization. And as always, we look at all sorts of opportunities around the world from an M&A standpoint. And as Russell likes to say, we don't really care whether we're buying our own yellow trucks or buying somebody else's."

A few junior miners which stand out to us as potentially attractive acquisition targets for GG are:

- Premier Gold Mines (PG.TO) - focused on Canada (Red Lake)

- Rubicon Minerals (RMX.TO) - focused on Canada (Red Lake)

- Torex Gold Resources (TXG.TO) - Mexico

- Cayden Resources (CYD.V) - Mexico

While guessing right as to GG's potential acquisition targets could lead to windfall profits, betting on GG itself looks like a solid long term investment prospect due to its top-notch management team and exceptional project portfolio. The GG Weekly chart shows a head & shoulders bottom pattern that we are all too familiar with among the gold miners. However, the recent 'flag' formation is 'high & tight' unlike many of its peers:

A breakout above resistance near $29 looms large

For more premium insights into our highest conviction investment ideas sign up for a subscription to CEO.CA's latest offering Resource Opportunities!