This morning Torex Gold (TXG:TSX) which has $90 million of warrants expiring tomorrow at an exercise price of $1.50, announced that they have signed a credit agreement with a syndicate of lenders for the previously announced $375 million project finance facility. This money is ear-marked for the development of the El Limon-Guajes project and represents the final piece of the financing.

Torex shares were the most traded shares so far today, with over 8 million traded on the TSX (another 4 million traded on other markets) with 55 minutes left in the day.

The $1.50 warrants will expire tomorrow at 5:00pm EDT. The company doesn't need the money to build El Limon, but would use the funds to advance their second and even higher-grade mine, Media Luna.

With the stock trading at $1.51 and the warrants trading at $0.01 it is unlikely that all $90 million will be exercised. However, the smart money will be.

In a second release this morning, Mr. Stanford President and CEO of Torex said, "With the recently announced project debt facility, we are now in a position to complete the construction of our El Limon-Guajes mine; however, the proceeds of the warrants would provide us the flexibility to advance engineering and early works at our Media Luna project, including land acquisition and permitting."

We will publishing an interview with the former President of Vale Inco Ontario, Mr. Fred Stanford exclusively on CEO.ca soon.

The company is currently under budget for their first mine and continue to prove the competency of their EPCM team.

"With this project financing, we are now in a position to complete the construction of our first mine on schedule and on budget, for commissioning in August of next year," Mr. Stanford said in the release this morning.

In late June, Torex announced they were able to re-work and bring forward 72,000 ounces of gold from the end of the mine-life to the beginning of the production schedule.

Readers should recall that the reason management has budgeted nearly 24 months of ramp-up is due to the limitation of mining faces. The North Nose pit (which the 72,000 ounces will be taken from) should help accelerate the ramp-up as well as increase the mill head-grade in the early life of the ramp-up period.

Although I am not a warrant holder, if I were I would be calling my broker to exercise.

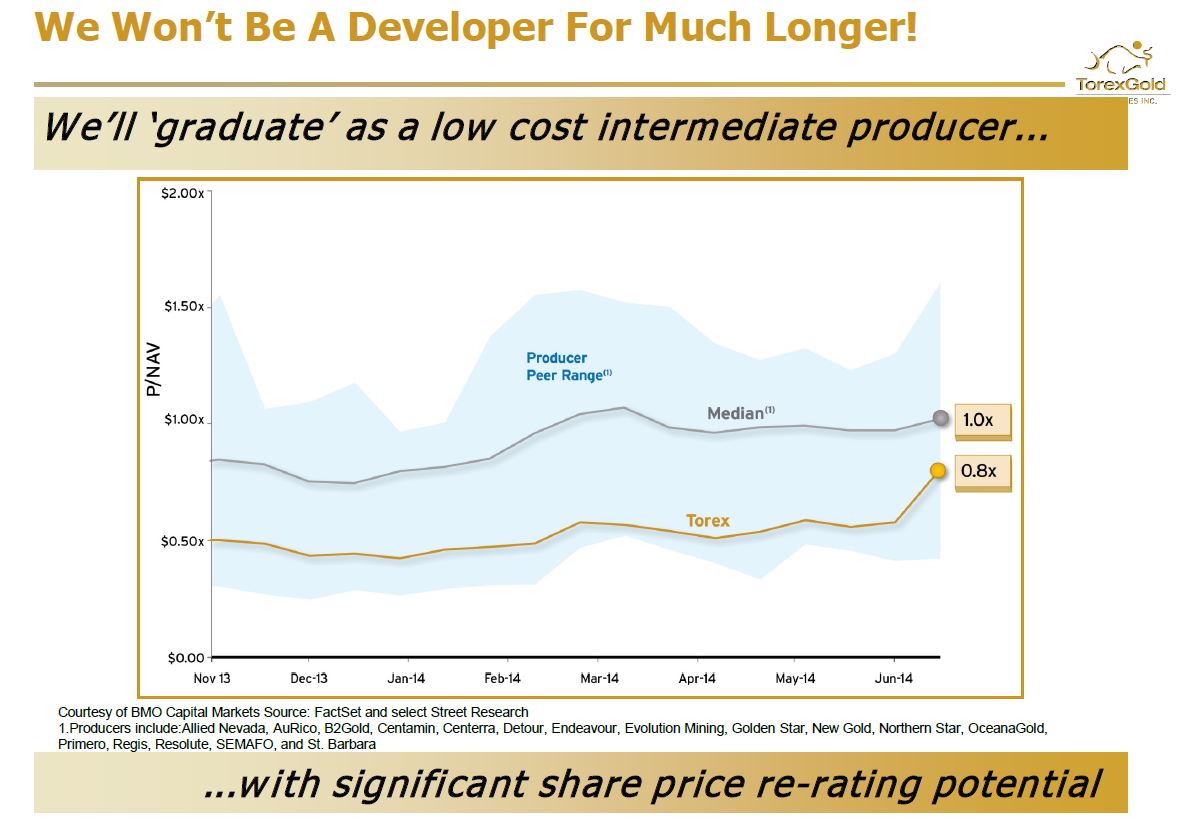

The reason? The company is fully financed to become a mid-tier gold producer producing an average of over 358,000 ounces of gold per year at the lowest quartile cash costs in the business ($504 per ounce). The project hosts some of the highest grades of any open-pit mine in the sector with a mill head grade of 2.61g/t and they have another 5 million ounce gold-equivalent discovery (Media Luna) that can be turned into their second mine in the future.

Analysts estimate the company could be generating $150 million per year in free cash flow by 2018.

The shorts have been pushing the stock down leading into the expiration of the warrants. When warrants are listed, traders will also often play the arb between the shares and the listed warrants, taking advantages of short-term opportunities.

If you were long and/or if you believed in the value proposition of Torex why would you let your at the money warrants expire and, instead, buy the shares of the market. At least when you exercise, your money will be going to the company to help them develop Media Luna as opposed to giving your money to another investor via the exchange.

The company has also been working to complete an updated resource estimate for the near-surface portion of the El Limon Sur target which is expected any day. The goal here is to convert inferred ounces into Measured and Indicated resources.

Additionally, as part of the annual Denver Gold Forum, Torex will be hosting an impressive site visit in September which will show the mill and highlight the fact they are one-year away from production (typically the point in which investors start to pay reasonable prices for future ounces). This should generate positive reports from analysts across the Street.

Read: Torex Completes US$375 Million Project Finance Facility El Limon-Guajes Project Fully Funded