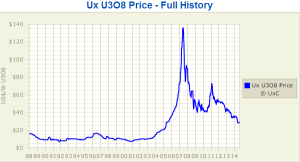

After a parabolic rise between 2004 and 2007 uranium has suffered through a rough last seven years. However, there are some clues that uranium prices may be in the process of bottoming:

Click to enlarge

Source: The Ux Consulting Company, LLC

$20 is clearly an important long-term price level that should act as major support - while it's still too early to emphatically declare that a bottom is in place, a move back above $35 would offer ample reason for optimism.

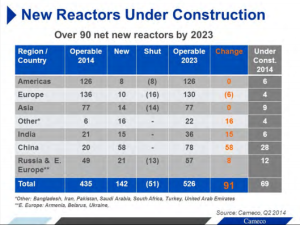

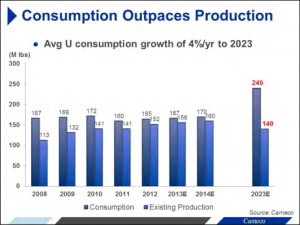

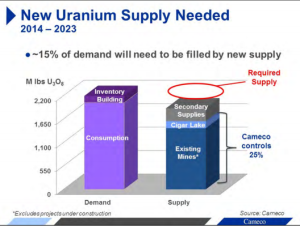

A recent Cameco (CCJ) investor presentation offers more clues as to where uranium prices may be headed:

The uranium supply shortfall is likely to accelerate over the coming years, particularly due to the recent exploration halts resulting from the poor uranium price performance and a decline in byproduct uranium production. The planet is starved for reliable sources of energy and nuclear continues to serve as a crucial source of clean, economic, and sustainable energy available on a massive scale.

Top junior producer picks Denison Mines (DML.TO) and Uranerz Energy (URZ.TO) stand to benefit tremendously should this turn out to be an important inflection point for uranium prices:

DML.TO Monthly

Top-tier uranium explorer with an impressive portfolio of projects. Long-term bottom in place, breaks out above $2

Uranerz Energy (URZ.TO)

Junior producer with flagship project in Wyoming. URZ has major support near $1.20.

Junior uranium explorers such as Fission Uranium (FCU.V) and NexGen Energy (NXE.V) also offer an attractive, albeit riskier, way for investors to play any future upside in the uranium price:

FCU.V Weekly

NXE.V Daily